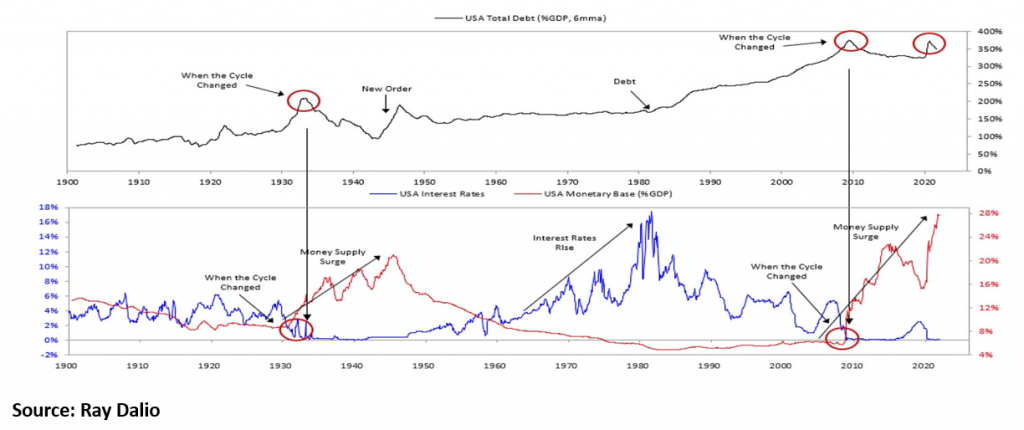

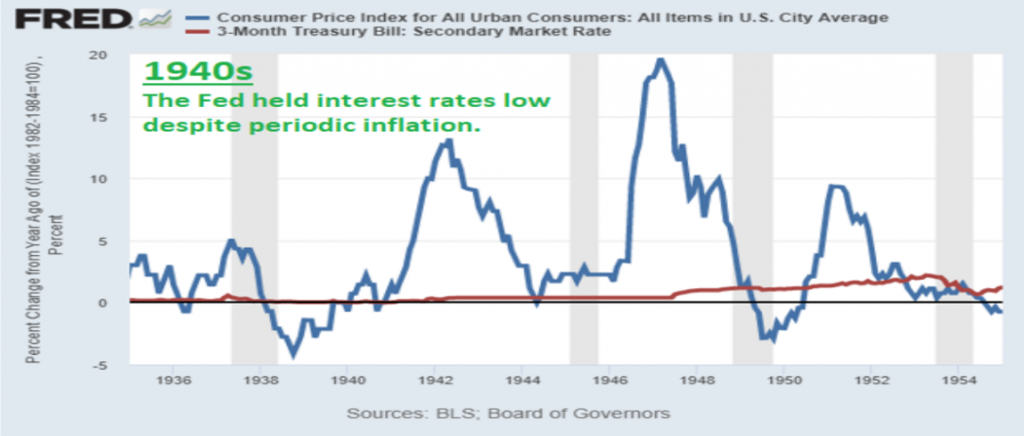

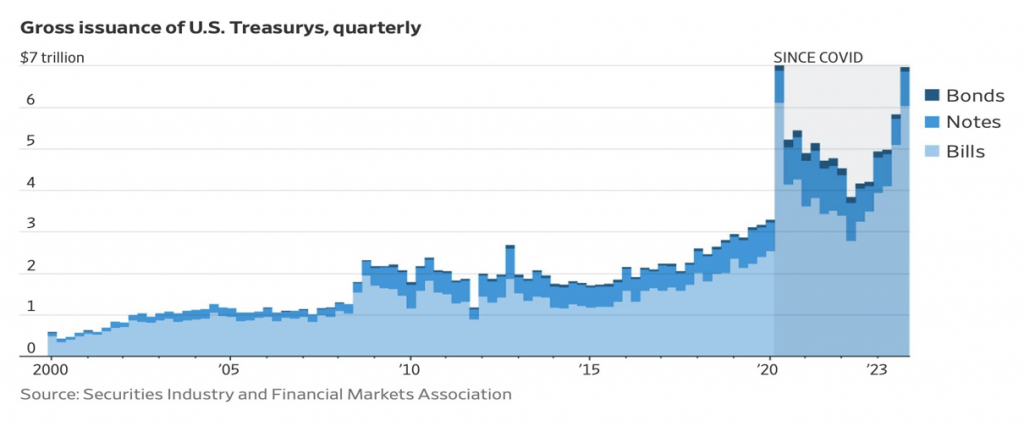

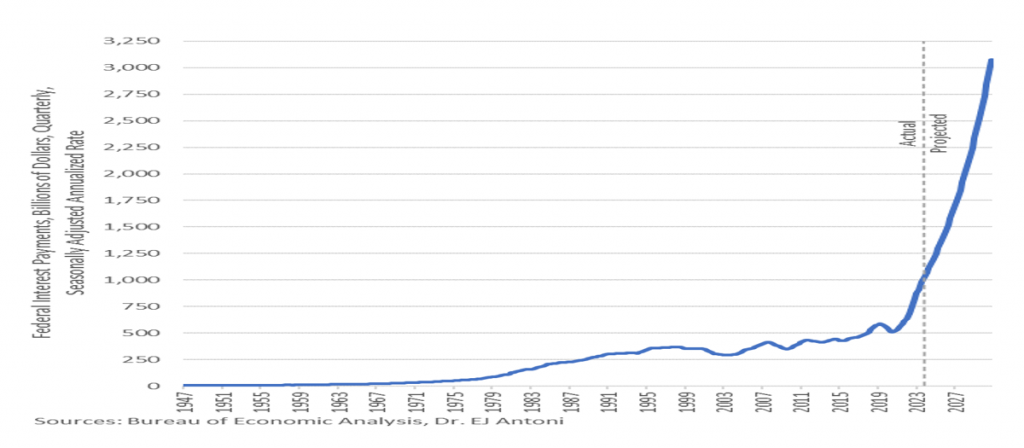

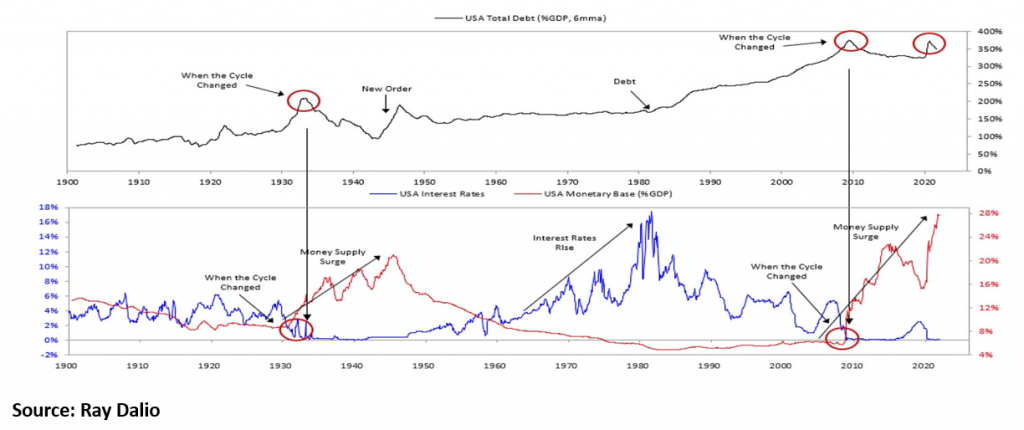

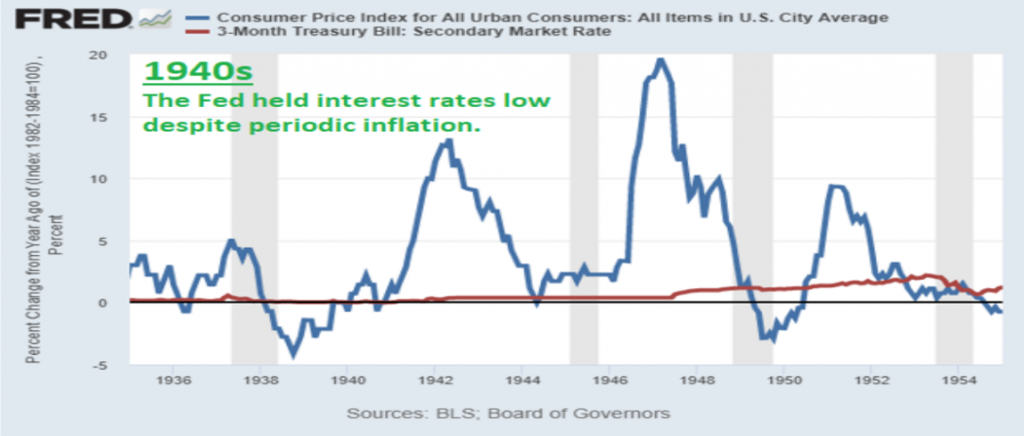

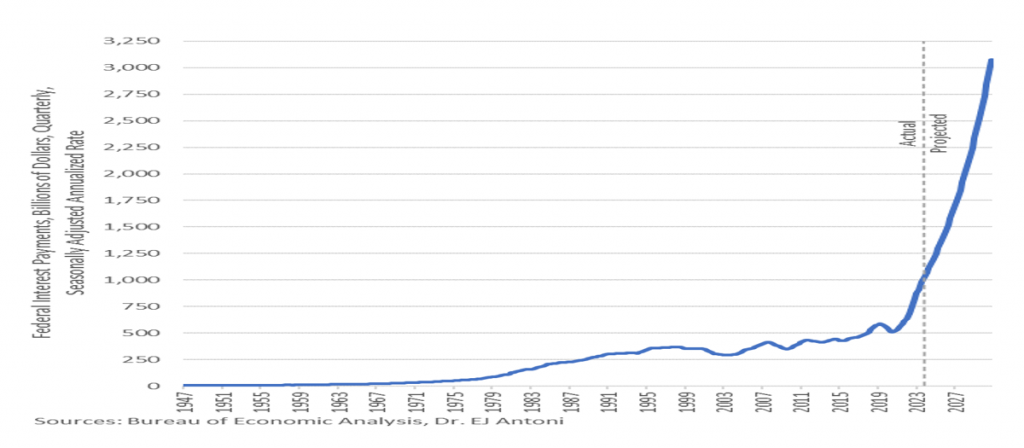

We are facing the 1940s play book in which Debt to GDP peaked at 119% before being inflated all the way down to 30% over 30 years.

Will History Repeat?

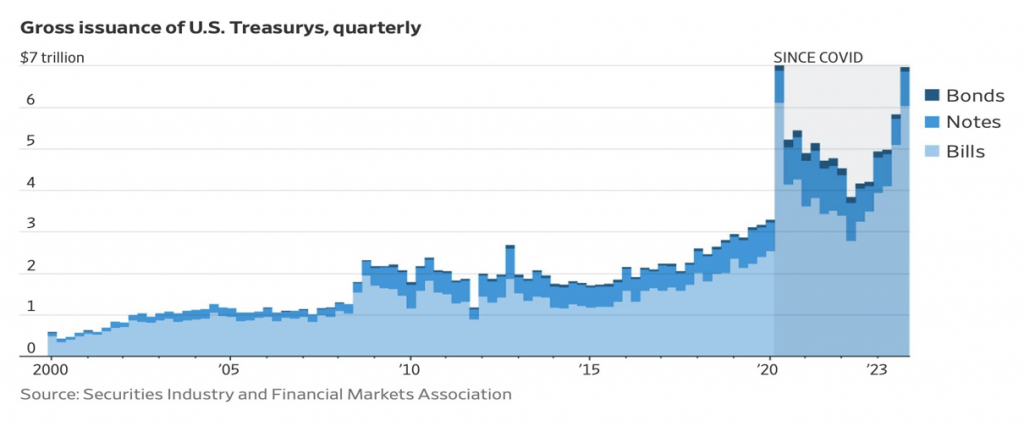

They are just going to inflate away the debt

Is this Hyperinflation?

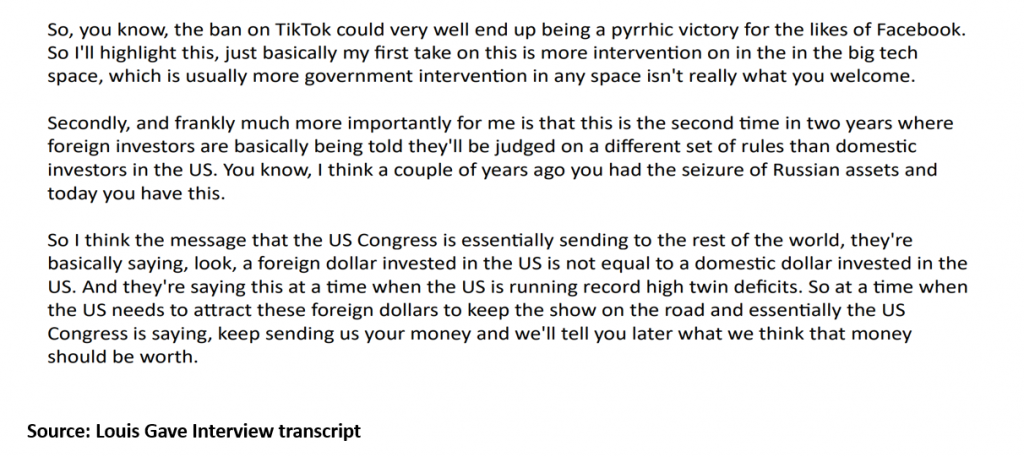

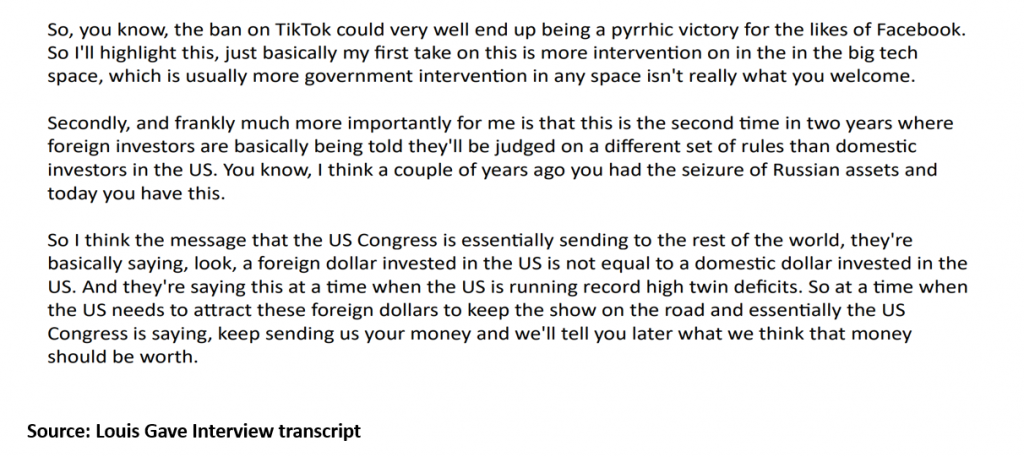

Russia FX reserves, Tik Tok, US steel Fiasco..Why own US Dollars?

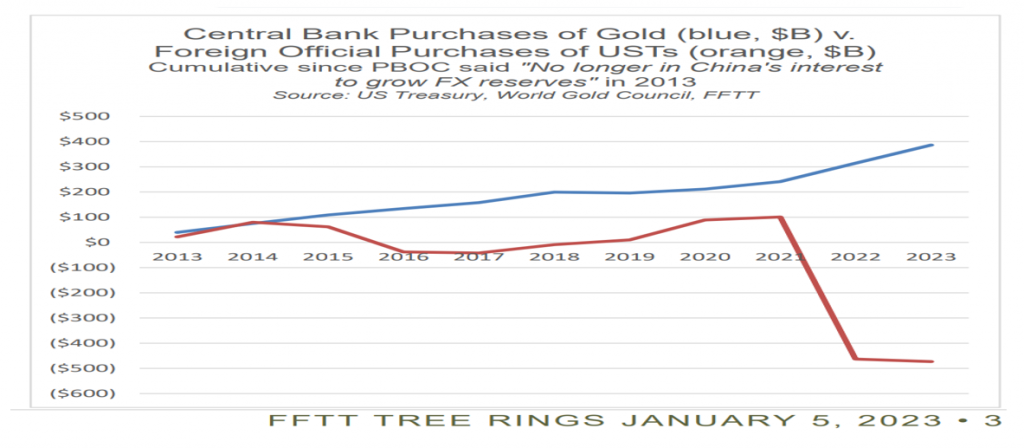

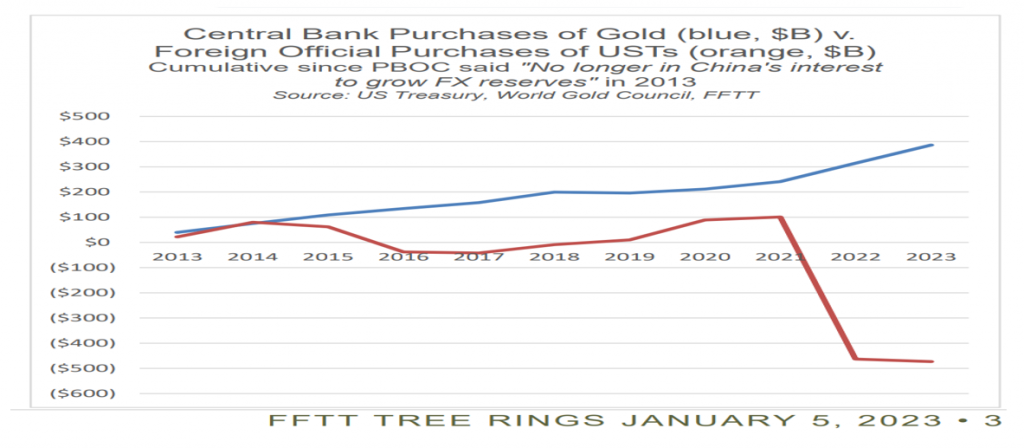

GOLD buying by Central Banks has accelerated since Russia Conflict

This is the reason US is afraid of China and wants to “Reindustrialize”

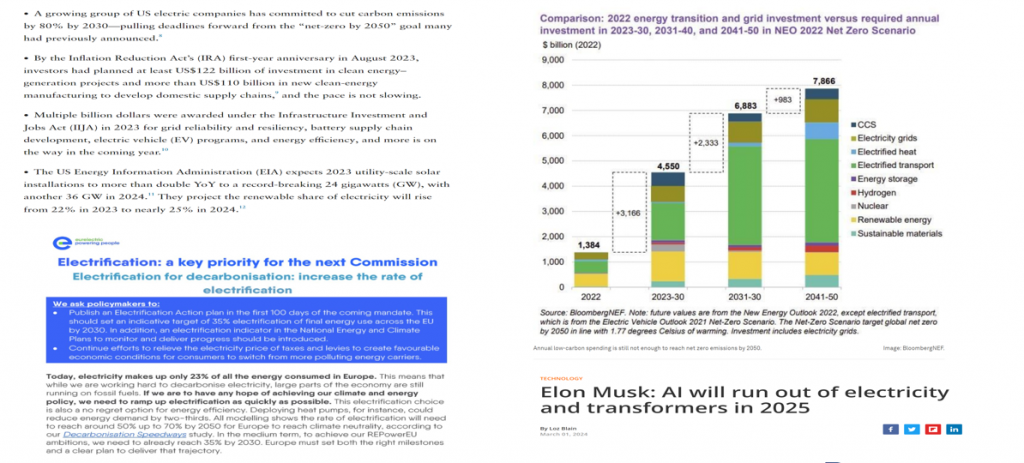

Macro theme - More money for US reindustrialization

80 years ago, the US Navy cleared 10 damaged ships from Pearl Harbor in 3 months and had most of them repaired in 8 months…

Now the Navy outsources its salvage operations to a European company.

It will take months to clear the Francis Scott Key Bridge and years to rebuild it. (Geiger Capital)

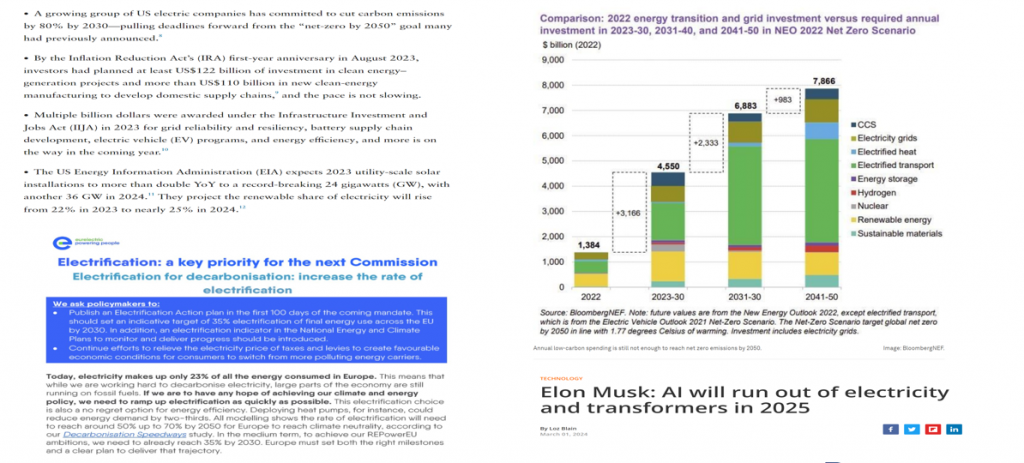

Macro theme of the decade - Electrification

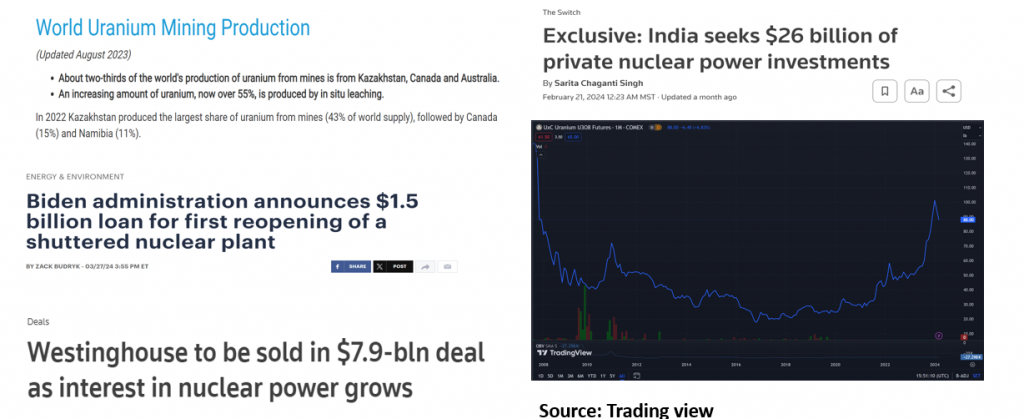

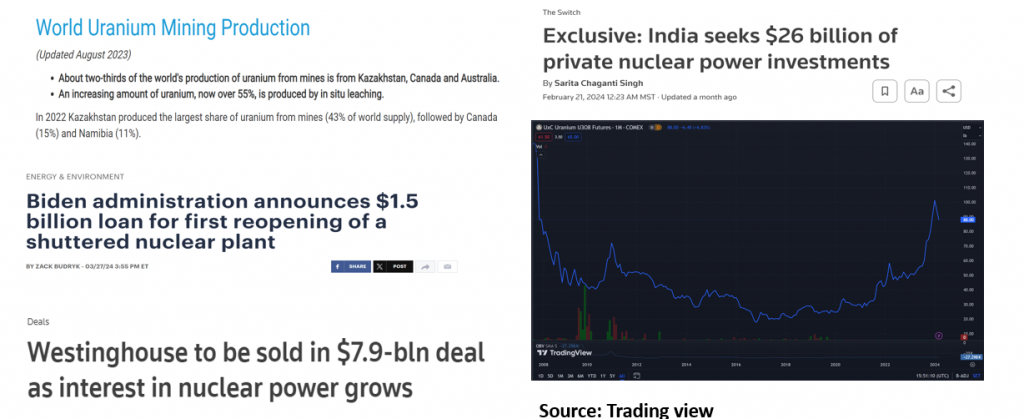

Connecting the dots - Nuclear Energy - the only clean, green and cheap energy

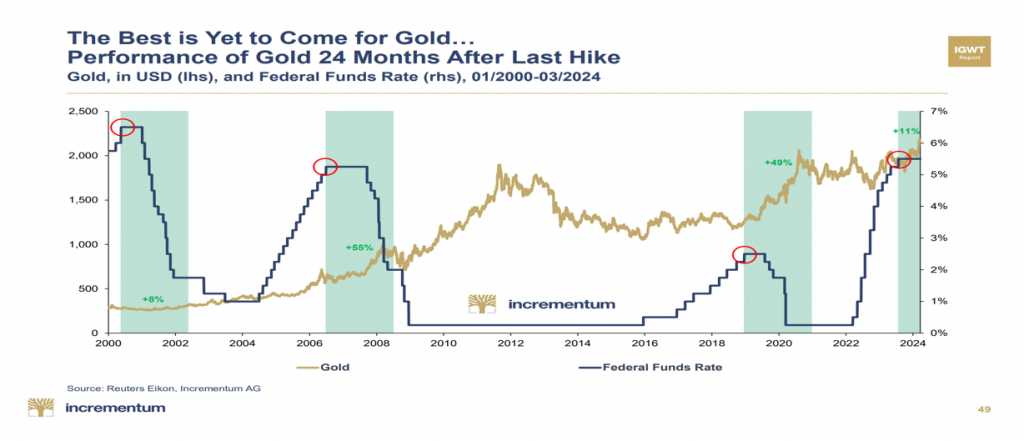

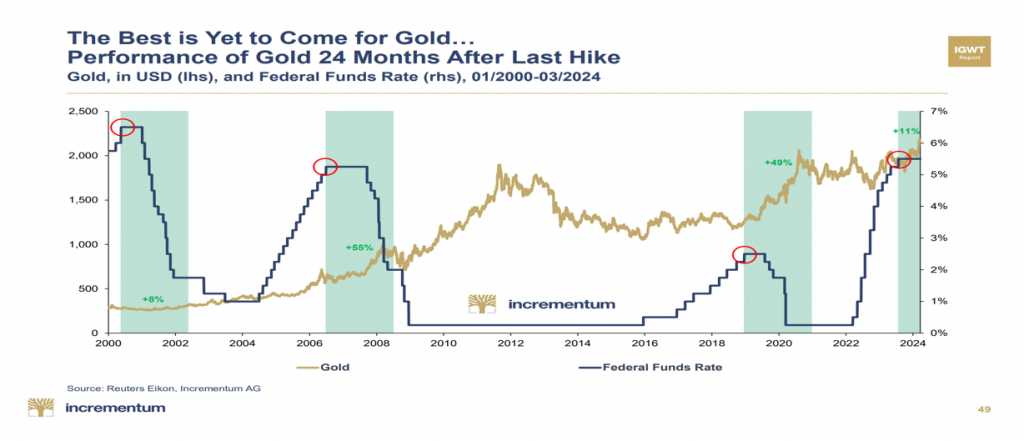

Last rate hike is the best time to own GOLD

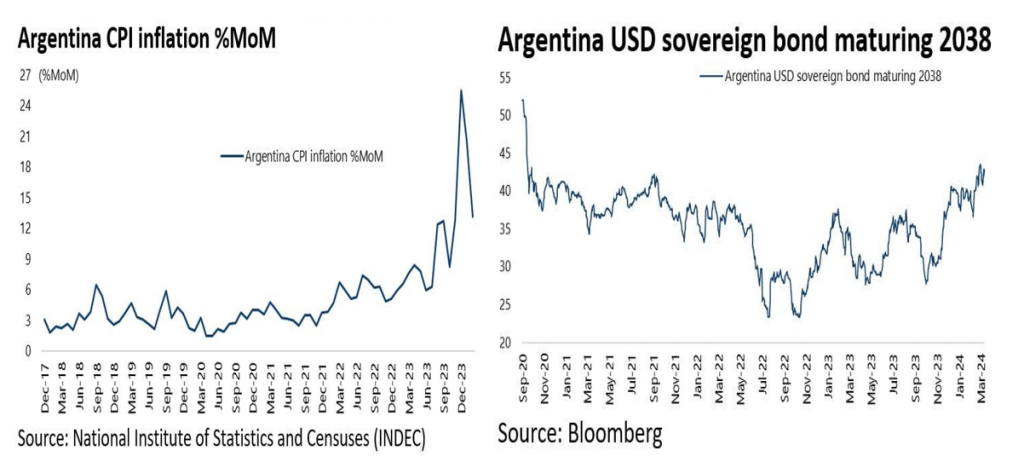

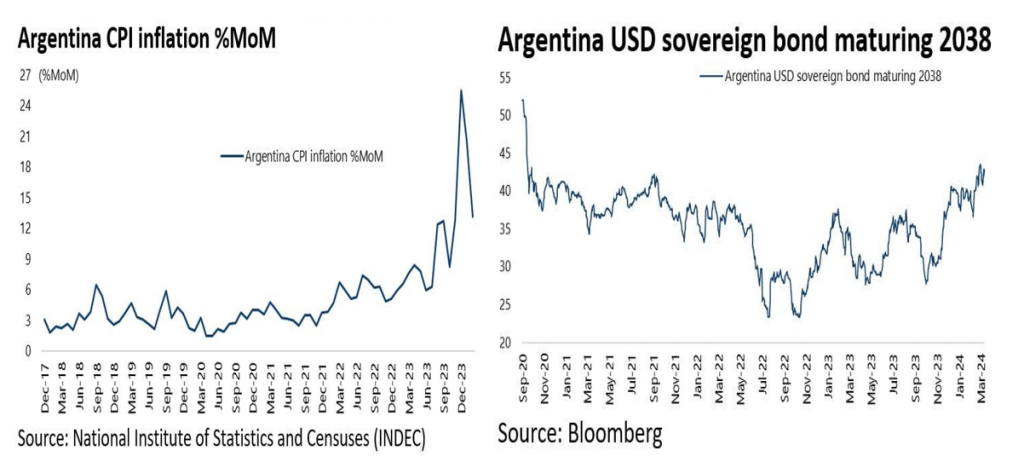

Millie policies working?

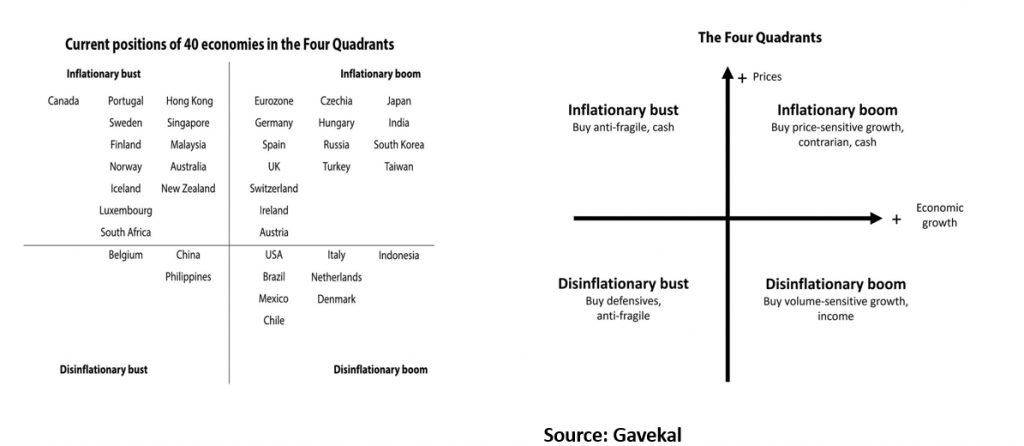

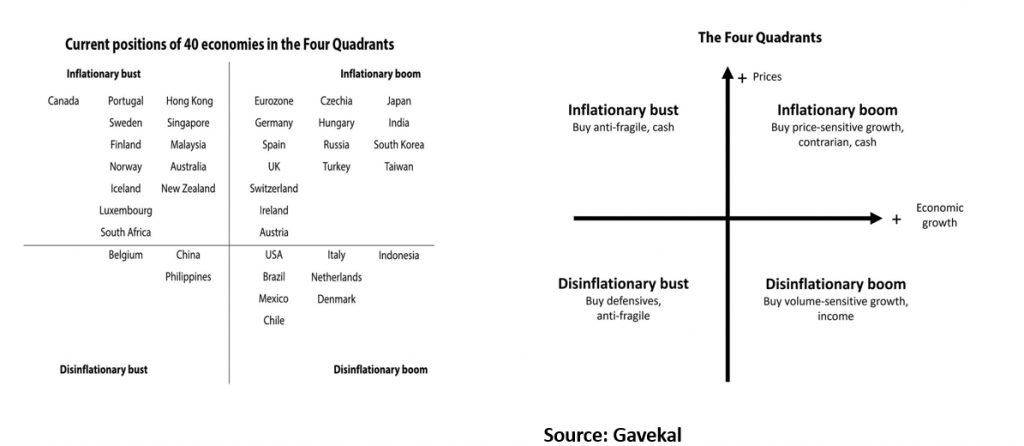

It’s Different This Time: Cyclical Changes For 2024

How to invest in a “Brave New World”

- Follow the liquidity in this “Brave New World”

- Mexico is the beneficiary of US chips/IRA LIQUIDITY

- Japan is a beneficiary of “INFLATING AWAY THE DEBT” liquidity

- Africa is the next frontier where liquidity battles will be fought.

- Precious metals are the beneficiary of diversifying away from reserve currency

- Reshoring/Friendshoring/Energy transition all require investment in Electrification ecosystem and Nuclear energy

- Finally in this Brave New World…listen to the Governments and the Regulators…if they don’t like anything don’t touch..if they are focusing on developing some part of economy, then it is a no brainer.

FOLLOW US:

Website: PINETREE MACRO – Offshore Investments

I can be reached at:

Ritesh Jain

Twitter: @riteshmjn

LinkedIn: https://www.linkedin.com/in/riteshmjain

Disclaimer

Pine Tree Macro Pvt Ltd ("Pine Tree"): This information provided is for the exclusive and confidential use of the addressee only. Any distribution, use or reproduction of this information without the prior written permission of Pine Tree is strictly prohibited. The information and any material provided in this document or in any communication containing a link to Pine Tree’s website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Pine Tree to any registration requirement within such jurisdiction or country. Neither the information, nor any material or opinion contained in this document constitutes a solicitation or offer by Pine Tree or its, directors and employees to buy or sell any securities, futures, options or other financial instruments or provide any investment advice or service. We do not represent that the information and any material provided on this website is accurate or complete. Pine Tree makes every effort to use reliable, comprehensive information; but makes no representations or warranties, express or implied or assumes any liability for the accuracy, completeness, or usefulness of any information contained in this document. All investments are subject to market risks. In no event will Pine Tree or its directors and employees be liable for any damages including without limitation direct or indirect, special, incidental, or consequential damages, losses or expenses arising out of and in connection with this website, or in connection with any failure of performance, error, omission, interruption, defect, delay in operation or transmission, computer virus or system failure.

Anantam International SPC Fund ("Fund") & Aparna Investment Management ("Manager"") : This report does not constitute an offer to sell, nor a solicitation of an offer to buy, interests in Anantam International SPC Fund and is not intended to create any rights or obligations

Aparna Investment Management shall not accept any liability if this report is used for an alternative purpose from which it is intended, nor to any third party in respect of this report. While all reasonable care has been taken in preparing this report, no responsibility and liability is acceptable for errors of fact or for any opinion expressed herein

The Anantam International SPC Fund and/or any of its officers, directors, personnel and employees shall not be held liable and responsible for any loss, damage of any nature, including but not limited to direct, indirect, incidental, punitive, special, exemplary, consequential, as also any loss of profit, revenue in any way arising from or in connection with the use of this statement in any manner whatsoever.

Past performance is not indicative of future results. The Anantam International SPC Fund does not provide any assurances as to the reliability of such information and you should not rely on this information when making an investment decision.

Opinions, projections and estimates contained in this report are subject to change without prior notice.

Registered Office

‘LORDS’, 7/1, Lords Sinha Rd., Kolkata, WB,

700071.

Write to us

info@pinetreemacro.com