Elephant In The Room - Debt

"Over the past two centuries, 51 out of 52 countries that reached sovereign debt levels of 130% of GDP ended up 'defaulting' [within 0 to 15 years], either through devaluation, inflation, restructuring, or outright nominal default."

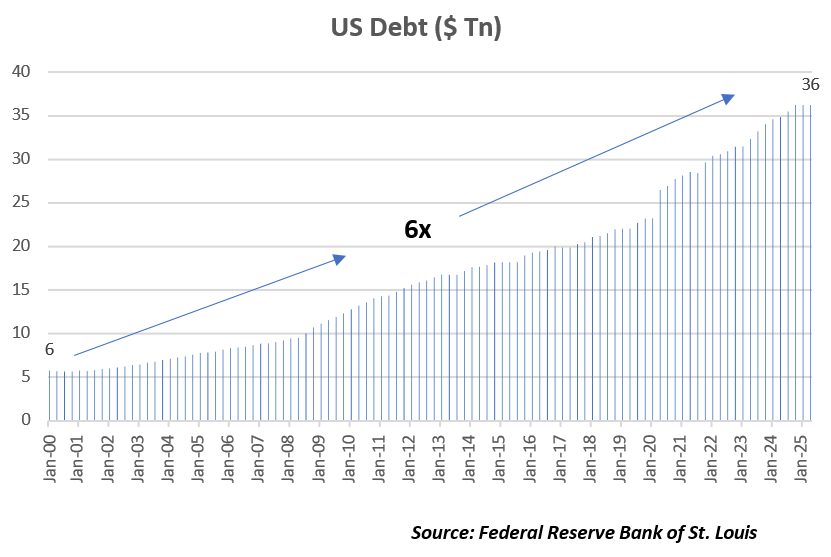

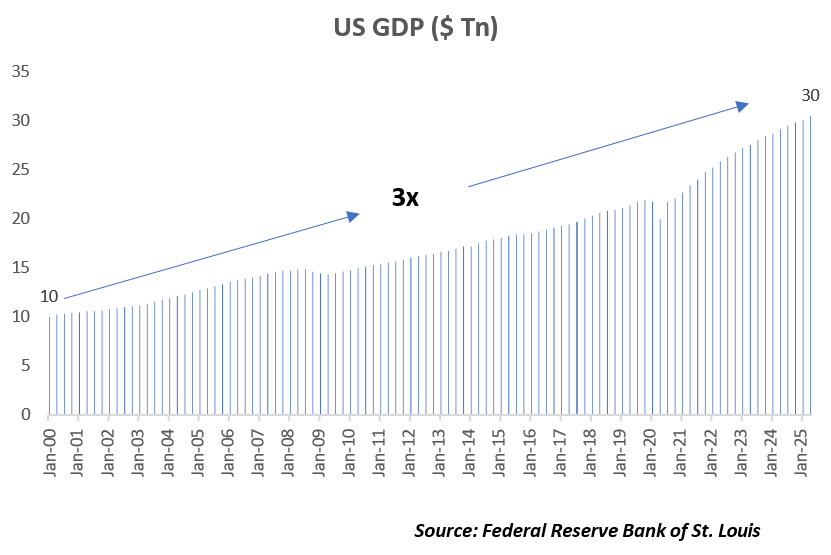

US debt has grown six times in the last 25 years, whereas US GDP has grown three times. Consequently, the US debt-to-GDP has doubled from ~57% to ~120%

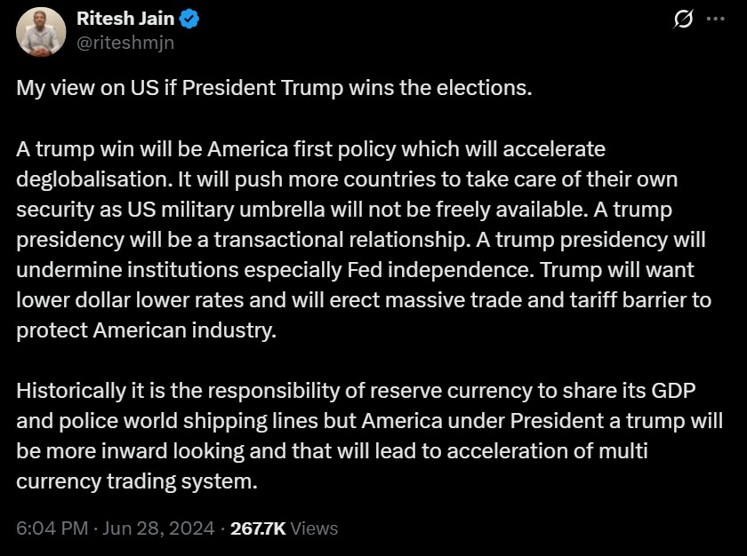

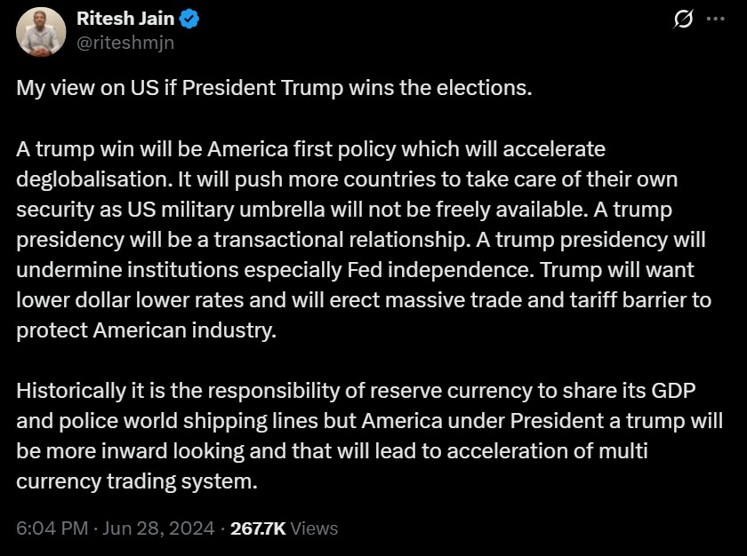

Our View On President Trump – Posted June 2024

https://x.com/riteshmjn/status/1806667412596740191?s=46&t=C3rli2FHgt3dUJcWQCNaZg

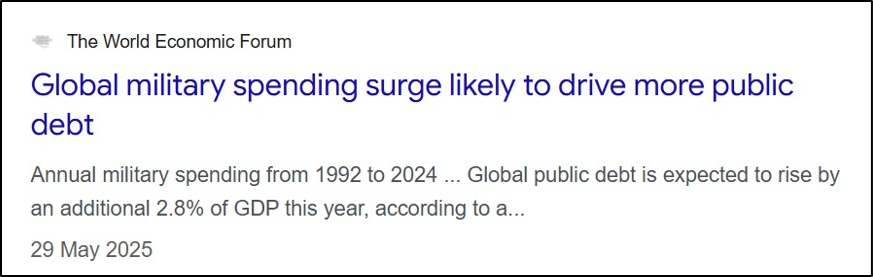

World Does Not Have A Hegemon - Global Defense Spending To Rise

No Appetite For Austerity: Governments Will Have to Give In Or Will Be Voted Out

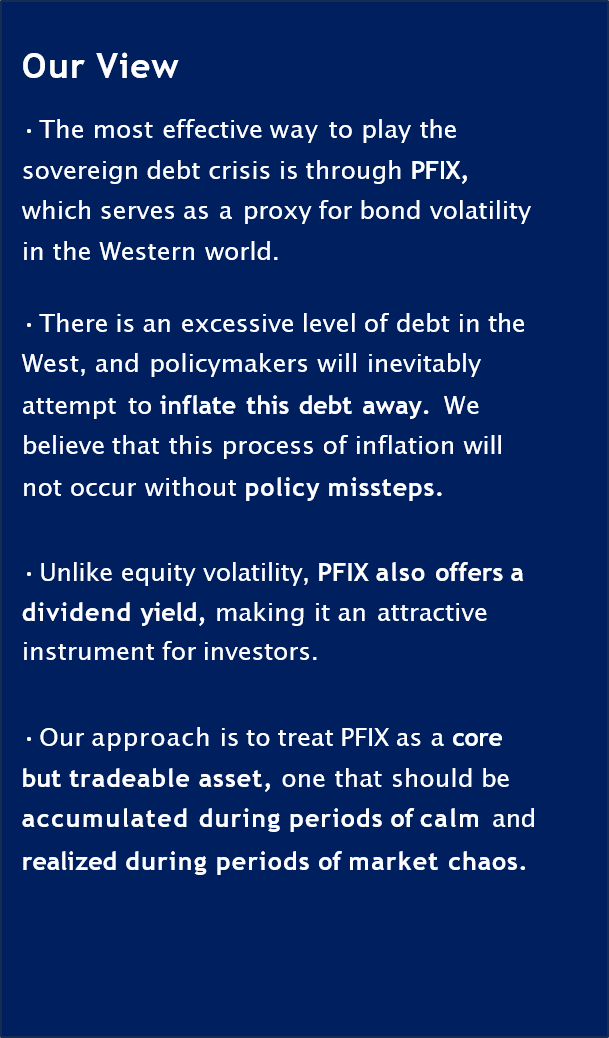

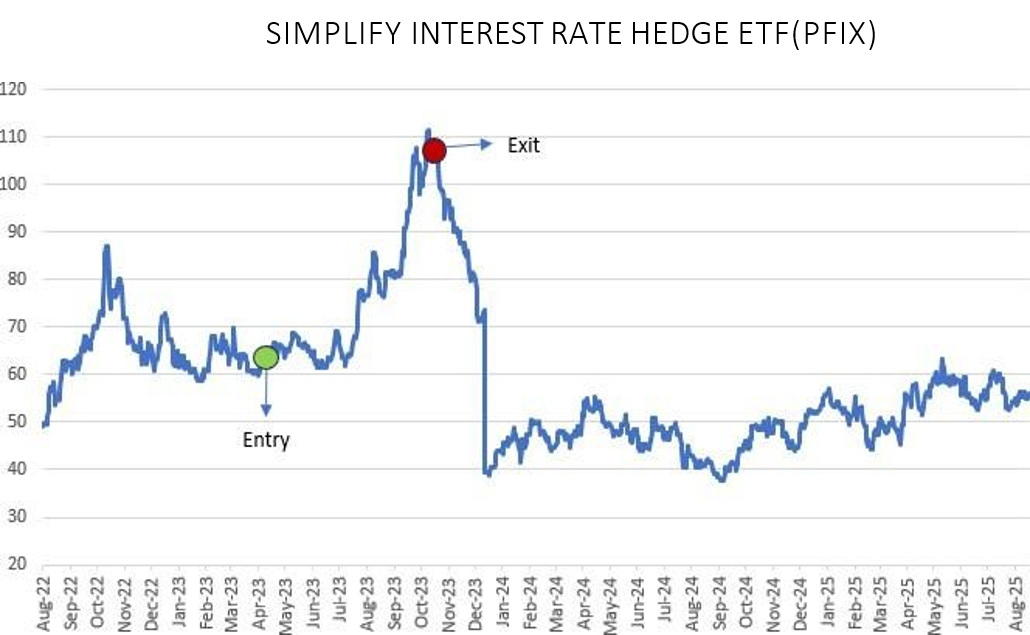

3% Is The New 2% - No Option Other Than To Inflate Away

Bonds - Certificate Of Confiscation In Western World

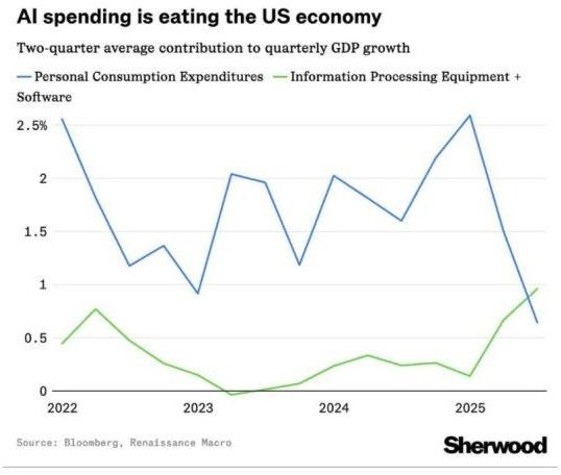

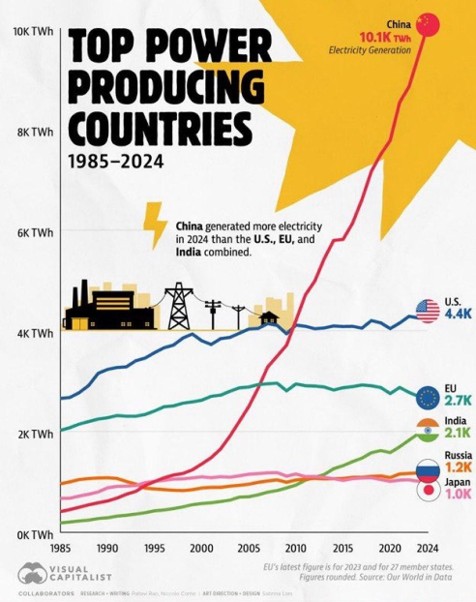

AI Keeping The US Economy Afloat But Focus On Electricity

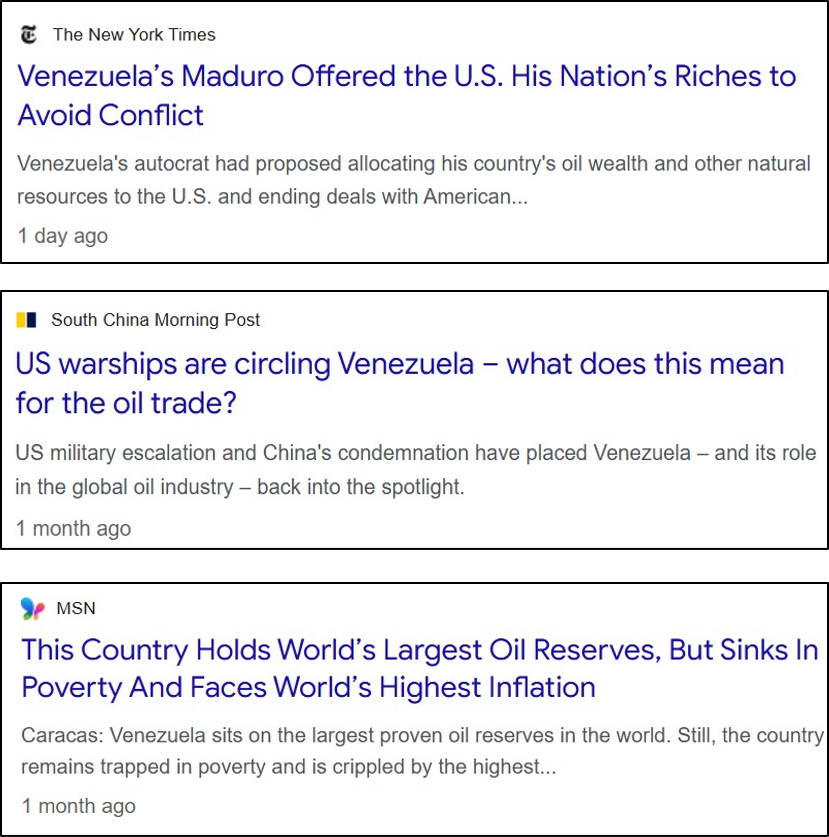

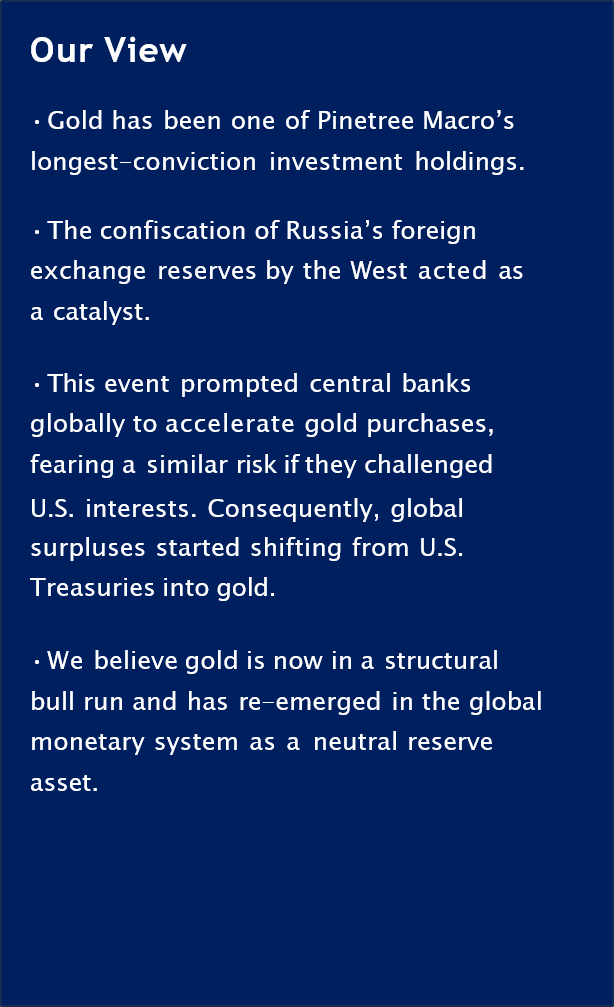

IRAQ..IRAN..SYRIA..RUSSIA.. Now VENEZUELA

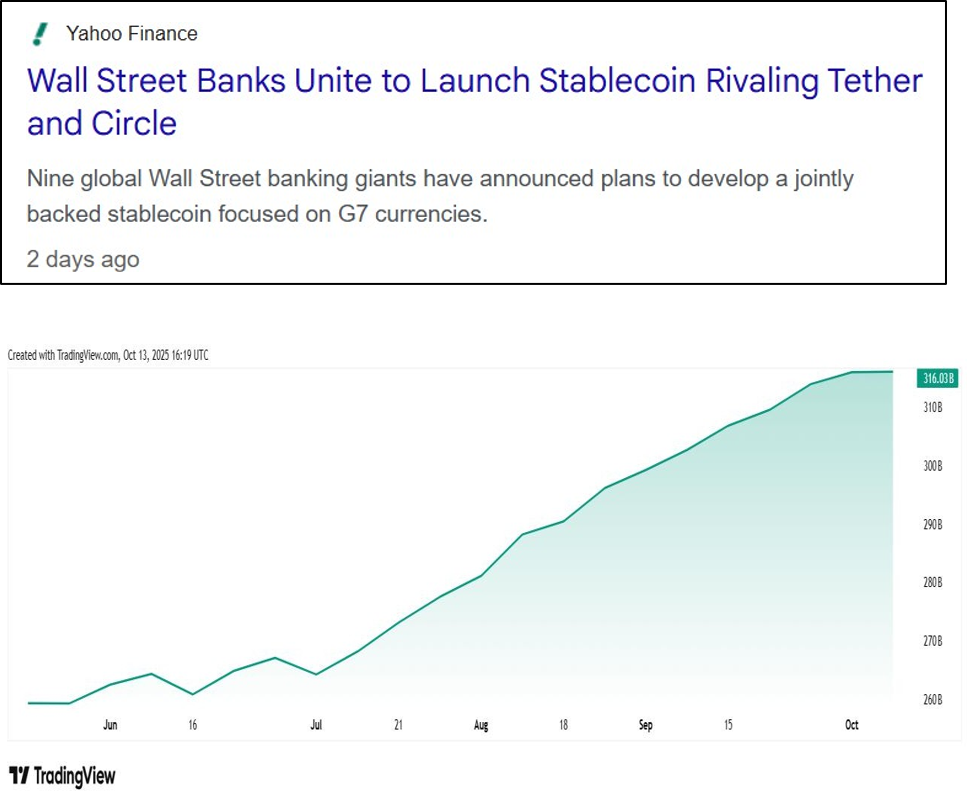

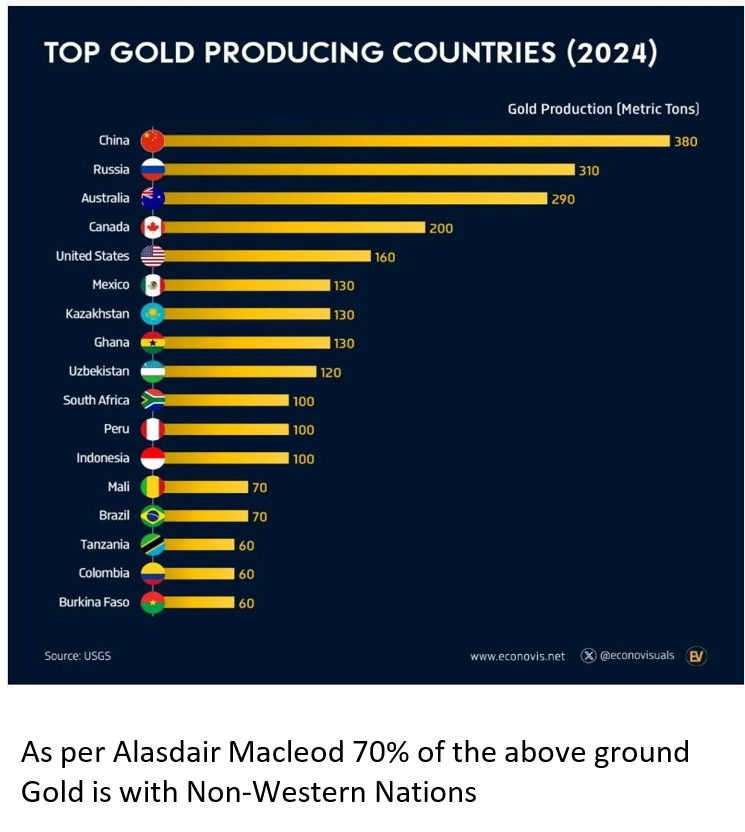

Bitcoin & Stablecoin vs Gold – Western Bloc vs BRICS

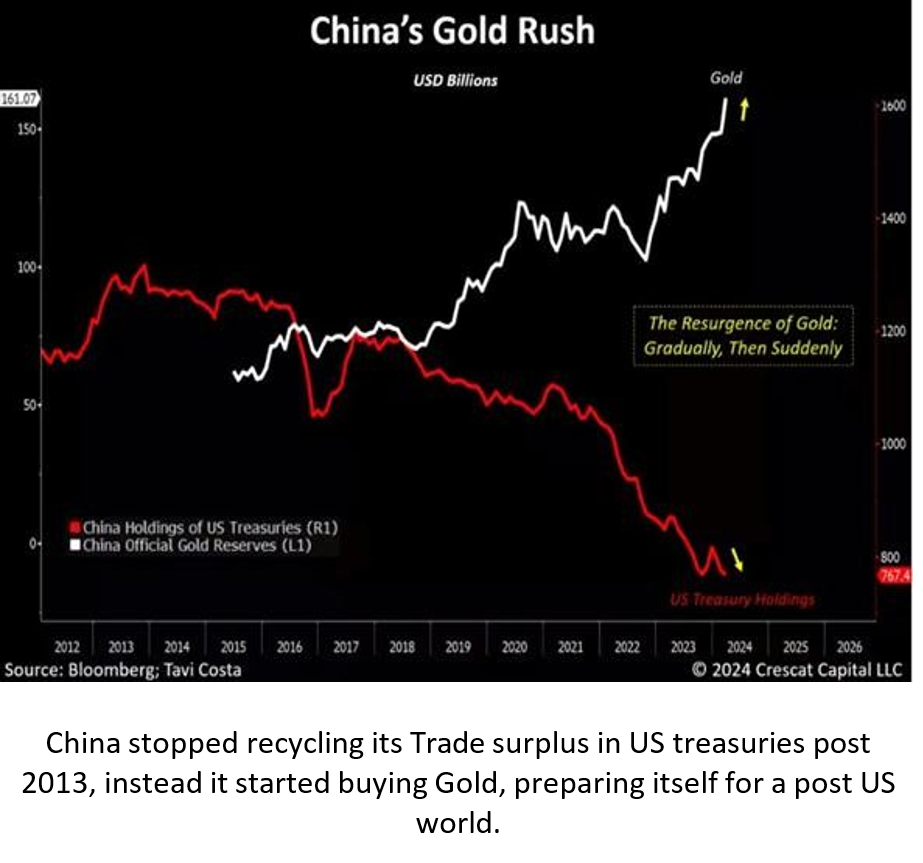

China Understood In 2013… ROW Understood It In 2022

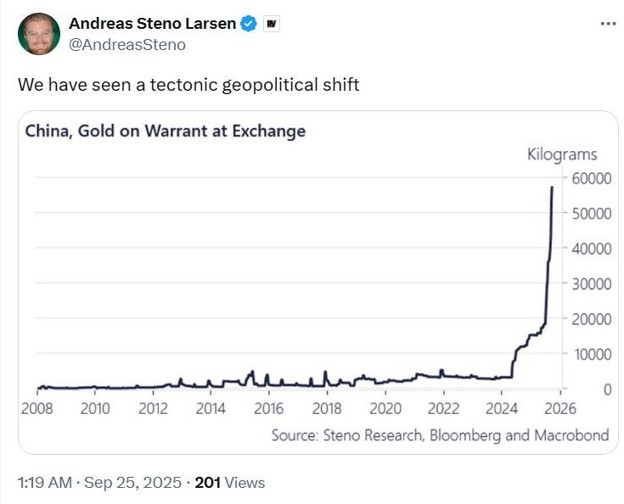

Vaults In Shanghai…Hongkong….Saudi Arabia

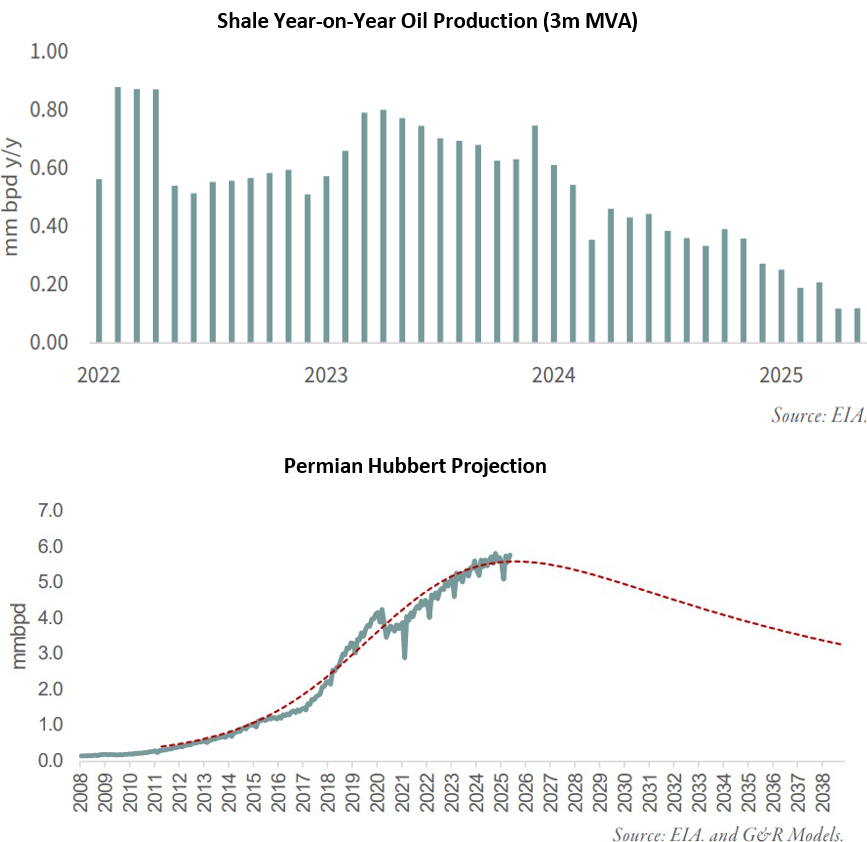

https://x.com/andreassteno/status/1970938624855375884?s=46&t=C3rli2FHgt3dUJcWQCNaZg

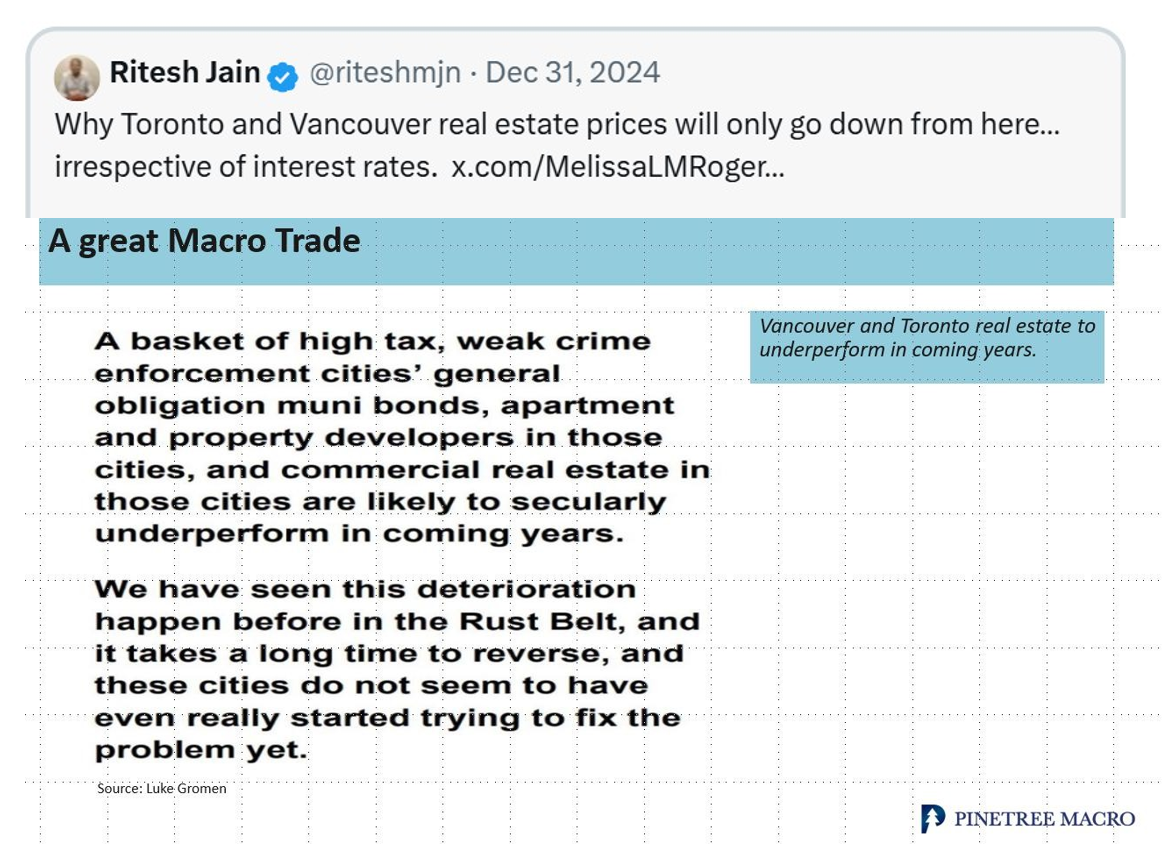

True For US…True For Canada…

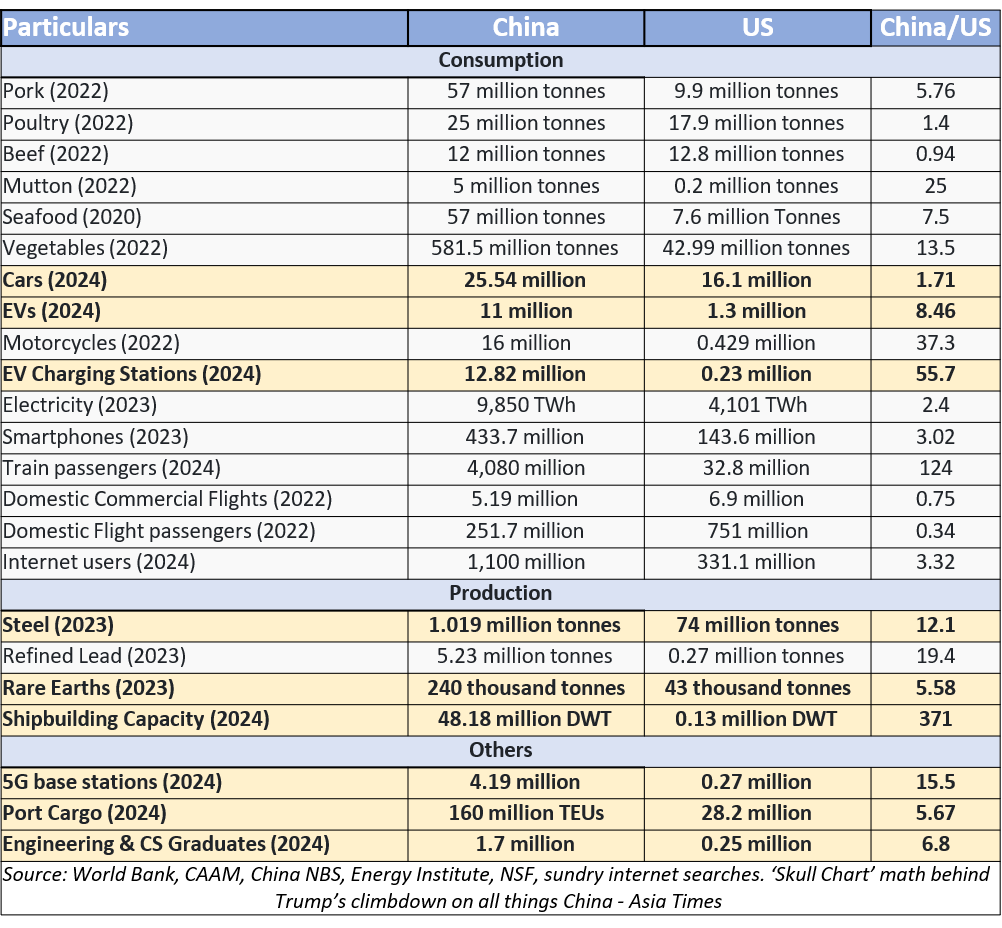

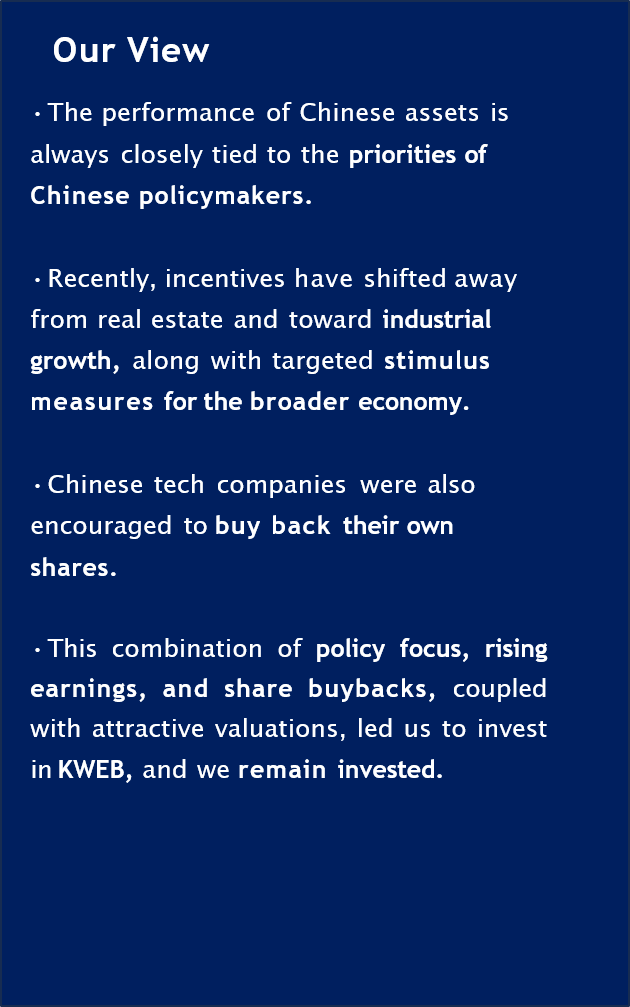

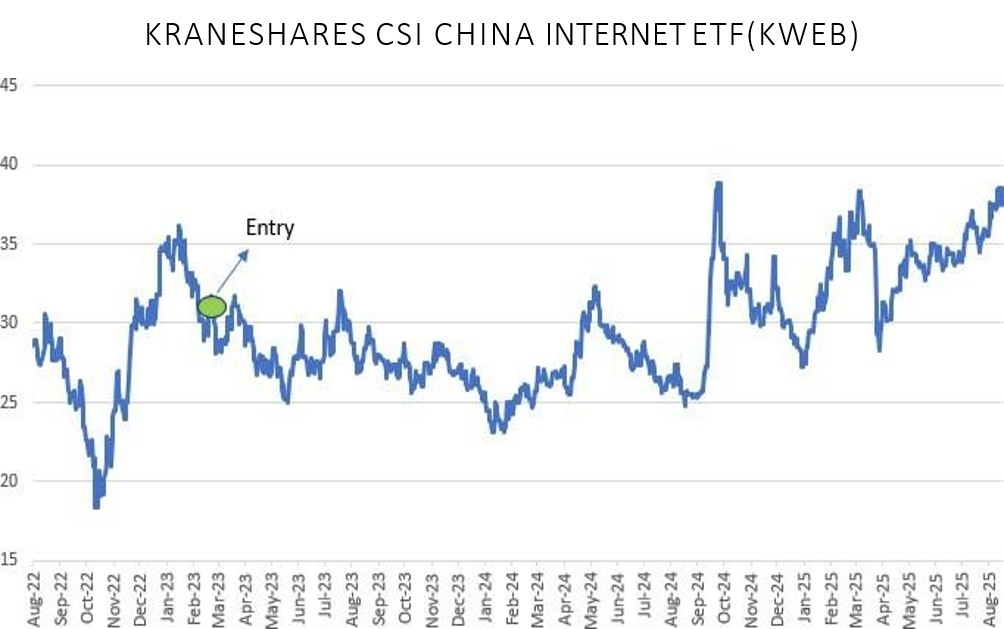

US vs China

India -The Problem Of High P/E And Low Nominal GDP

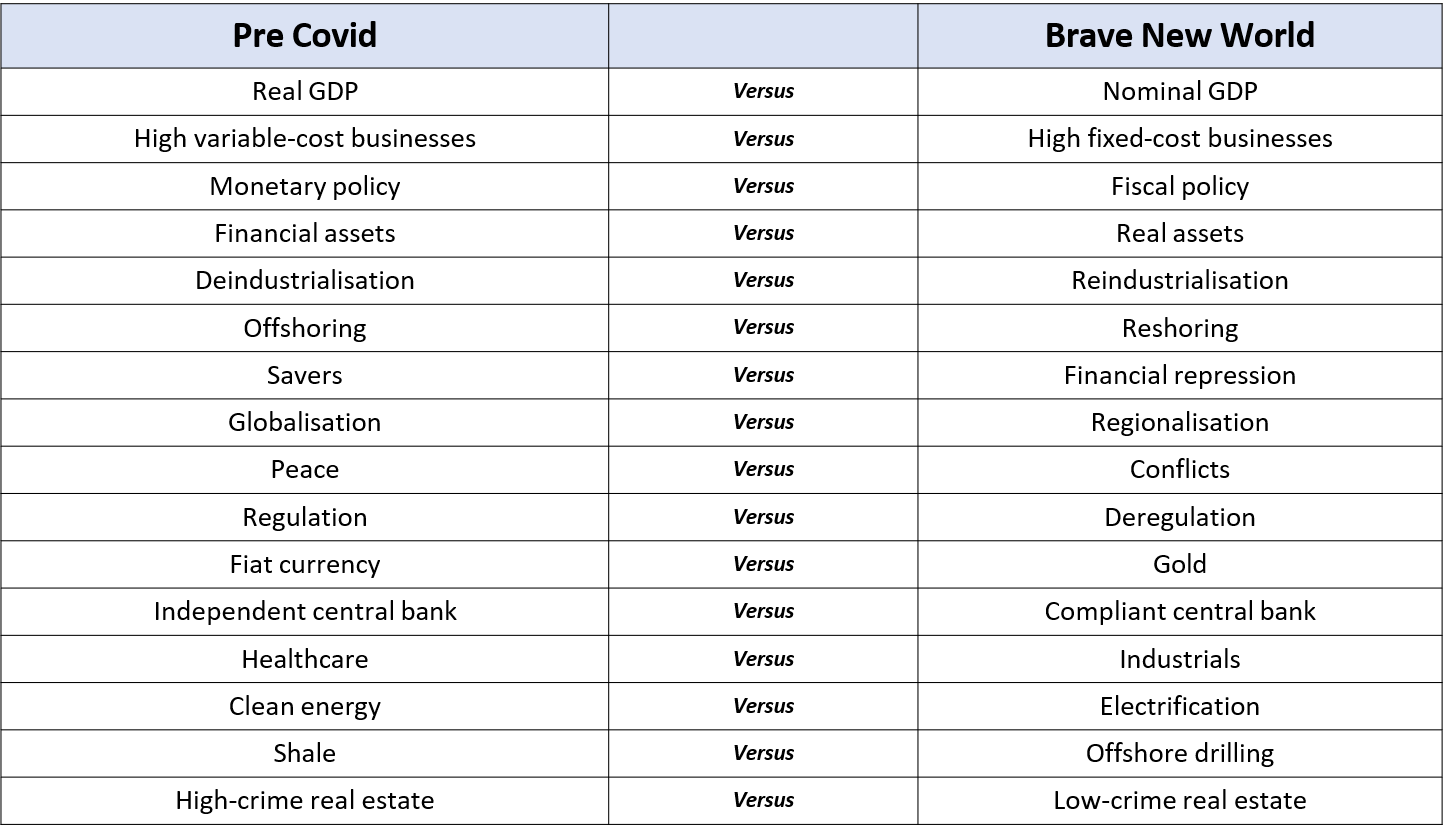

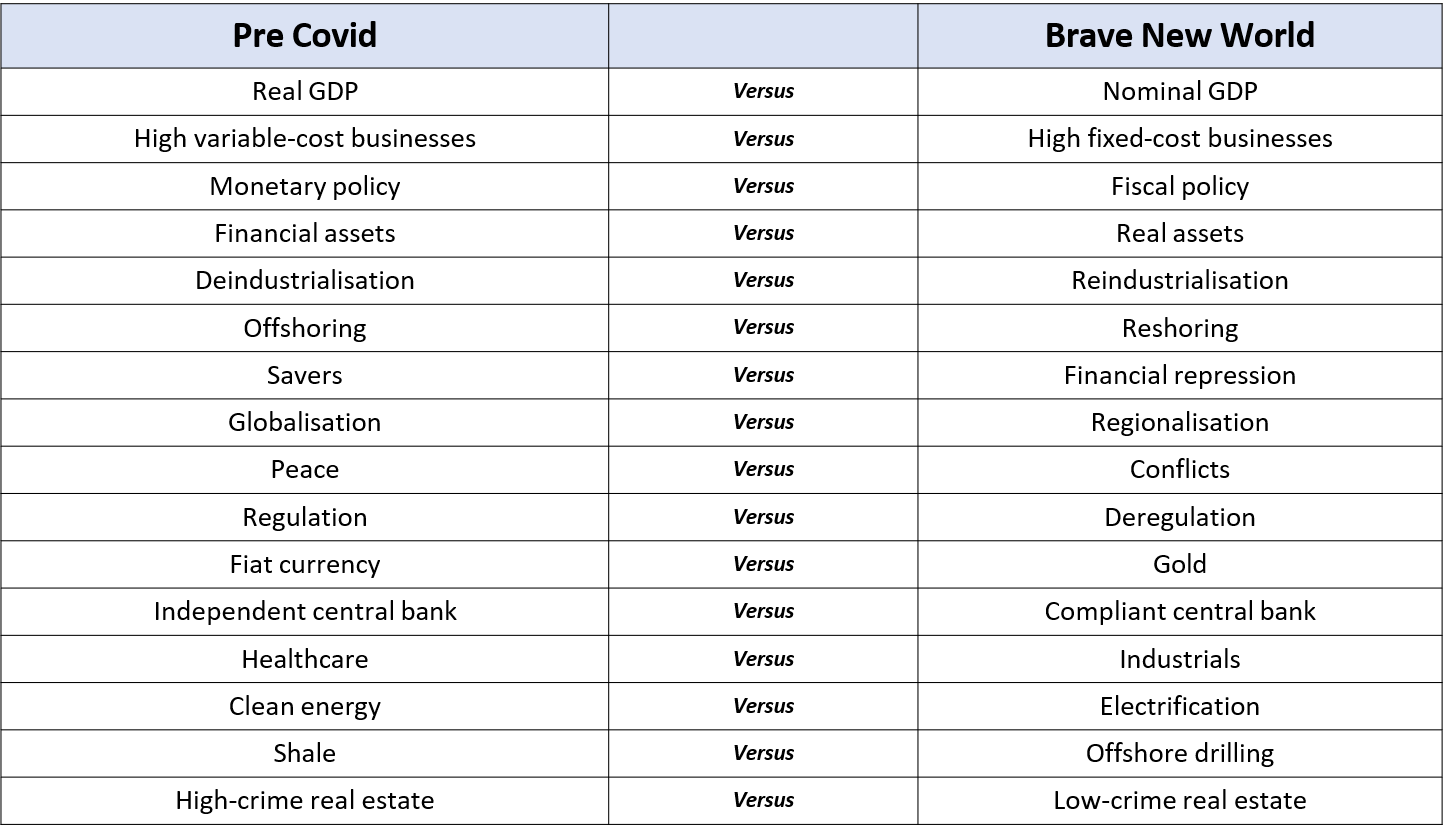

How To Invest In A Brave New World

Conclusion

-

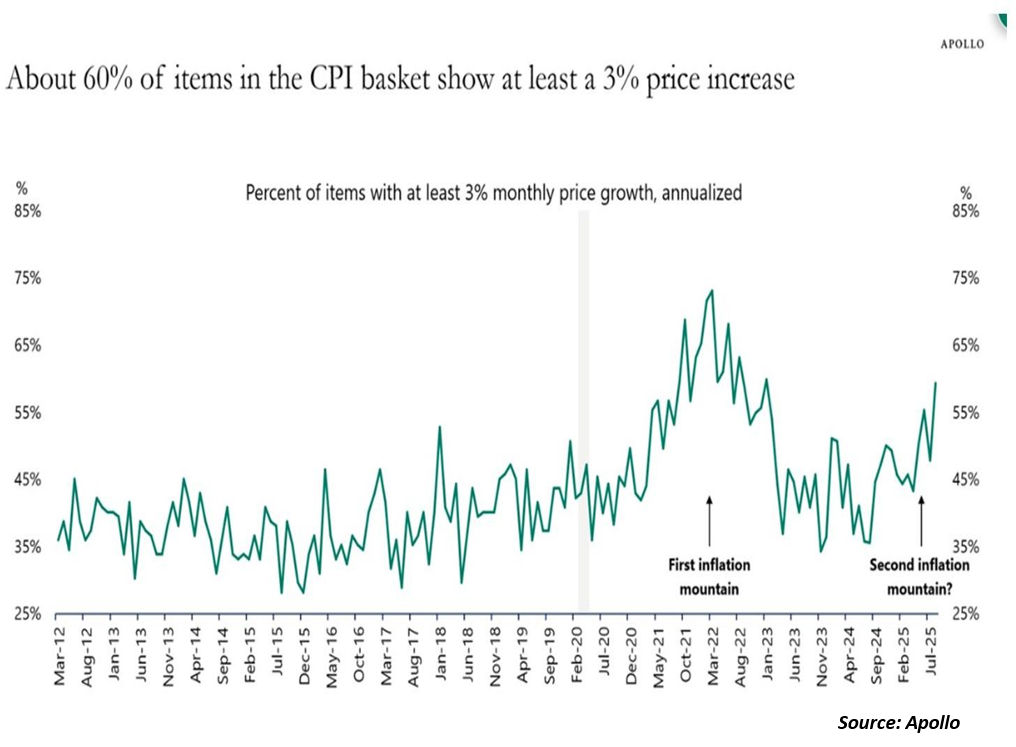

3% is the new 2%. Inflation is here to stay; there is no turning back.

-

AI is a Bubble, but if you want to play this bubble, then play through "Picks and shovels".

-

The US is no longer willing to bear the burden of policing the world and sharing its GDP with the rest of the world; the world is rearming, and military spending is now on the rise.

-

India's Nominal GDP settling below double digits is not good news for Indian equities. There are better stories out there.

-

The Western World is facing sovereign debt crisis and they would be inflating away their debt.

-

Lower bond yields and higher asset prices are a matter of "NATIONAL SECURITY" in the US.

-

Focus on assets that benefit from Nominal GDP over real GDP and pick High fixed cost businesses over high variable cost businesses.

-

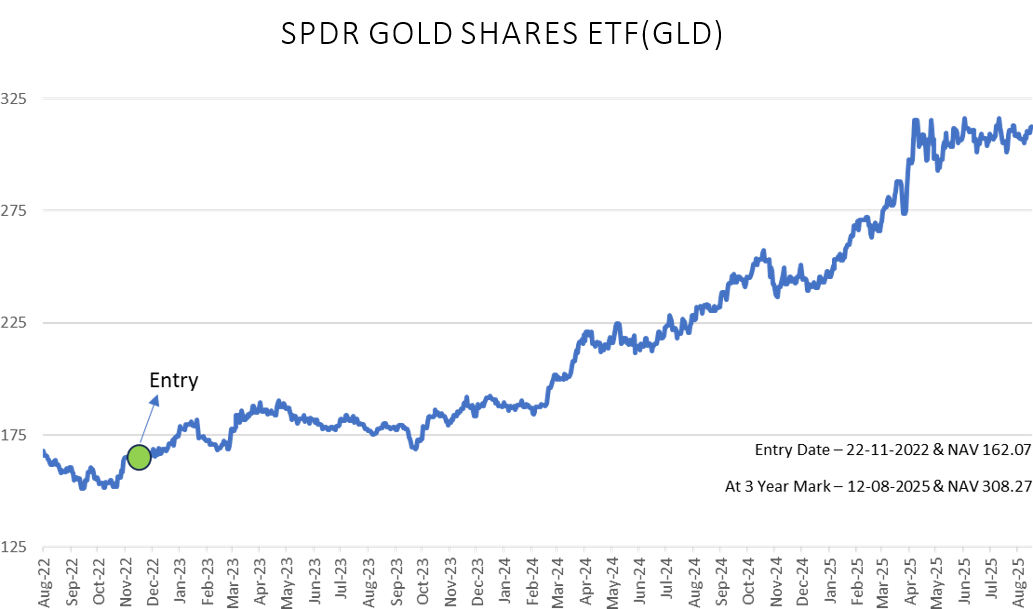

Gold is back in the monetary system as a neutral reserve asset.

FOLLOW US:

Website: PINETREE MACRO – Offshore Investments

I can be reached at:

Ritesh Jain

Twitter: @riteshmjn

LinkedIn: https://www.linkedin.com/in/riteshmjain

Disclaimer

Pine Tree Macro Pvt Ltd ("Pine Tree"): This information provided is for the exclusive and confidential use of the addressee only. Any distribution, use or reproduction of this information without the prior written permission of Pine Tree is strictly prohibited. The information and any material provided in this document or in any communication containing a link to Pine Tree’s website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Pine Tree to any registration requirement within such jurisdiction or country. Neither the information, nor any material or opinion contained in this document constitutes a solicitation or offer by Pine Tree or its, directors and employees to buy or sell any securities, futures, options or other financial instruments or provide any investment advice or service. We do not represent that the information and any material provided on this website is accurate or complete. Pine Tree makes every effort to use reliable, comprehensive information; but makes no representations or warranties, express or implied or assumes any liability for the accuracy, completeness, or usefulness of any information contained in this document. All investments are subject to market risks. In no event will Pine Tree or its directors and employees be liable for any damages including without limitation direct or indirect, special, incidental, or consequential damages, losses or expenses arising out of and in connection with this website, or in connection with any failure of performance, error, omission, interruption, defect, delay in operation or transmission, computer virus or system failure.

Anantam International SPC Fund ("Fund") & Dovetail Investment Management Ltd ("Manager") : This report does not constitute an offer to sell, nor a solicitation of an offer to buy, interests in Anantam International SPC Fund and is not intended to create any rights or obligations.

Dovetail Investment Management Ltd shall not accept any liability if this report is used for an alternative purpose from which it is intended, nor to any third party in respect of this report. While all reasonable care has been taken in preparing this report, no responsibility and liability is acceptable for errors of fact or for any opinion expressed herein.

The Anantam International SPC Fund and/or any of its officers, directors, personnel and employees shall not be held liable and responsible for any loss, damage of any nature, including but not limited to direct, indirect, incidental, punitive, special, exemplary, consequential, as also any loss of profit, revenue in any way arising from or in connection with the use of this statement in any manner whatsoever.

Past performance is not indicative of future results. The Anantam International SPC Fund does not provide any assurances as to the reliability of such information and you should not rely on this information when making an investment decision.

Opinions, projections and estimates contained in this report are subject to change without prior notice.

Registered Office

‘LORDS’, 7/1, Lords Sinha Rd., Kolkata, WB,

700071.

Write to us

info@pinetreemacro.com