Anantam International SPC Fund - 6 SP (Cayman)

-

Markets and the business cycle are both becoming more unpredictable with time, but strangely, equity or bond volatility is contained.

-

President Trump does not want a trade war. He simply wants US to manufacture more goods. US accounts for 29% of global consumption, it produces only 15% of the world’s goods. China accounts for 32% of global manufacturing but just 12% of global consumption. I believe the solution is to invite Chinese companies to manufacture in the US by hiring local US workers. This is the best thing that can happen to the global economy and I am banking and positioned for that in my portfolio.

-

I am also of the opinion that the investing landscape is changing and a US that does not want to share its GDP nor interested in policing the world will lead to global capital moving away from the US dollar. We believe the age of US exceptionalism is over.

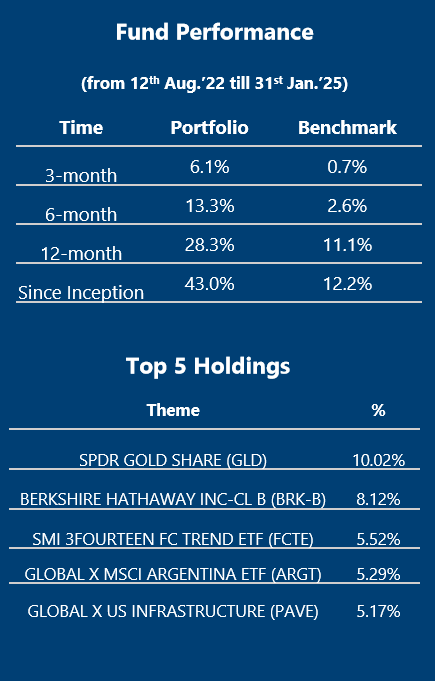

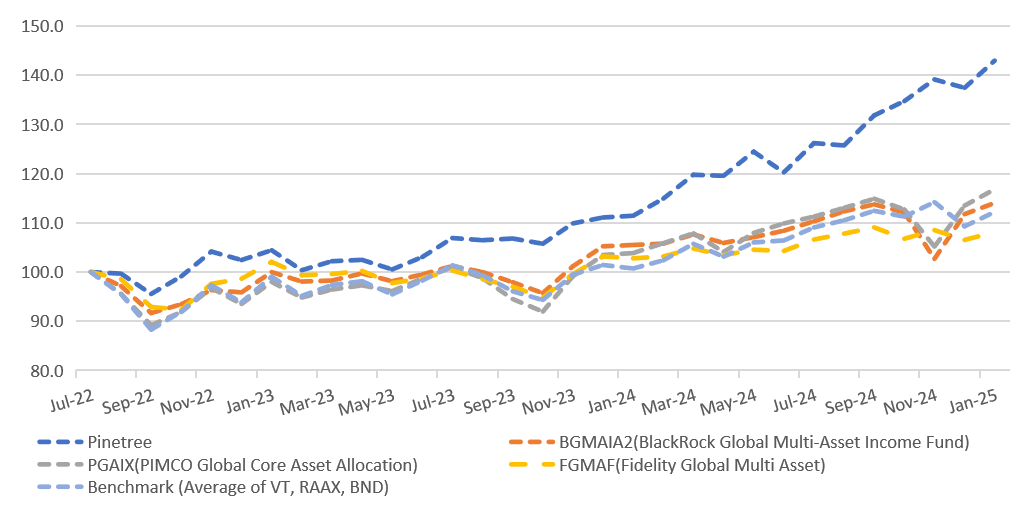

Performance Since Inception (%)

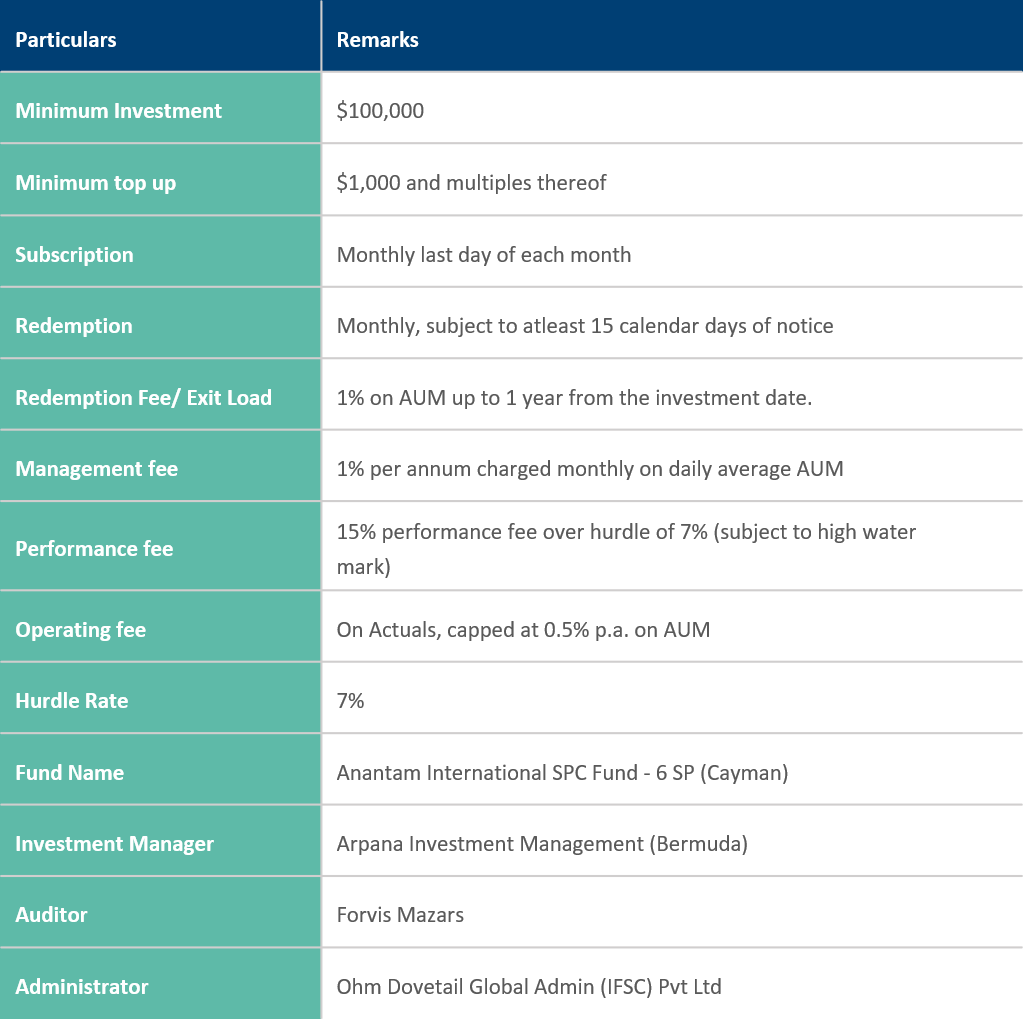

To provide with income generation and capital appreciation through investments in equities, bonds and other related securities of emerging and developed markets. This objective is to be achieved by investing in debt, quasi equity (including convertible bonds, warrants, etc.) and equity shares, both listed and unlisted in, developed, emerging and frontier markets.

Benchmark is a blend of Vanguard total world stock Index ETF (VT) - 34%, Vanguard total bond market ETF (BND) - 33% & VanEck Inflation Allocation ETF (RAAX) – 33%. ETFs are chosen for the benchmark to reflect the diversified nature of the underlying portfolio. Peers in the space typically use a 60:40 combination of MSCI World stock Index and Bloomberg global bond Index as benchmark.

The reason for including real asset as a part of benchmark - As early sings of multi polar currency world emerges, the efficiency of supply chains will be challenged pushing the cost of procurement upwards. As developed economies struggle through the massive debt burden creating an overhang on fiscal & monetary policies; real asset owners like commodity producers, efficient commodity procurers may emerge as winners. Inclusion of real assets in the Benchmark has increased the challenge for the fund as hard commodities act as inflation hedge.

FOLLOW US:

Website: PINETREE MACRO – Offshore Investments

I can be reached at:

Ritesh Jain

Twitter: @riteshmjn

LinkedIn: https://www.linkedin.com/in/riteshmjain

Disclaimer

Pine Tree Macro Pvt Ltd ("Pine Tree"): This information provided is for the exclusive and confidential use of the addressee only. Any distribution, use or reproduction of this information without the prior written permission of Pine Tree is strictly prohibited. The information and any material provided in this document or in any communication containing a link to Pine Tree’s website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Pine Tree to any registration requirement within such jurisdiction or country. Neither the information, nor any material or opinion contained in this document constitutes a solicitation or offer by Pine Tree or its, directors and employees to buy or sell any securities, futures, options or other financial instruments or provide any investment advice or service. We do not represent that the information and any material provided on this website is accurate or complete. Pine Tree makes every effort to use reliable, comprehensive information; but makes no representations or warranties, express or implied or assumes any liability for the accuracy, completeness, or usefulness of any information contained in this document. All investments are subject to market risks. In no event will Pine Tree or its directors and employees be liable for any damages including without limitation direct or indirect, special, incidental, or consequential damages, losses or expenses arising out of and in connection with this website, or in connection with any failure of performance, error, omission, interruption, defect, delay in operation or transmission, computer virus or system failure.

Anantam International SPC Fund ("Fund") & Aparna Investment Management ("Manager"") : This report does not constitute an offer to sell, nor a solicitation of an offer to buy, interests in Anantam International SPC Fund and is not intended to create any rights or obligations

Aparna Investment Management shall not accept any liability if this report is used for an alternative purpose from which it is intended, nor to any third party in respect of this report. While all reasonable care has been taken in preparing this report, no responsibility and liability is acceptable for errors of fact or for any opinion expressed herein

The Anantam International SPC Fund and/or any of its officers, directors, personnel and employees shall not be held liable and responsible for any loss, damage of any nature, including but not limited to direct, indirect, incidental, punitive, special, exemplary, consequential, as also any loss of profit, revenue in any way arising from or in connection with the use of this statement in any manner whatsoever.

Past performance is not indicative of future results. The Anantam International SPC Fund does not provide any assurances as to the reliability of such information and you should not rely on this information when making an investment decision.

Opinions, projections and estimates contained in this report are subject to change without prior notice.

Registered Office

‘LORDS’, 7/1, Lords Sinha Rd., Kolkata, WB,

700071.

Write to us

info@pinetreemacro.com