One year ago, I started this substack to share my views with the world, and I never, in my wildest dream, thought that we would be able to get the love and support of thousands of friends. It has been an incredible and unforgettable journey which will be cherished for life.

I am grateful to all of you and sincerely hope you love the unbiased updates about the latest macro developments.

For our 1st Anniversary, I had a special guest on our monthly podcast.

Ritesh Jain is a market veteran who has managed billions of dollars across various Fixed Income Funds and has been the LinkedIn Top Voice 2019. He is currently running his own macro firm, PineTree Macro, in Canada.

We started by discussing the hottest topic trending across social media since Xi Jinping visited Russia. A slew of decisions post Xi’s visit indicate that countries across Asia ex-Japan, are working round the clock and taking swift actions towards their “de-dollarization” dream.

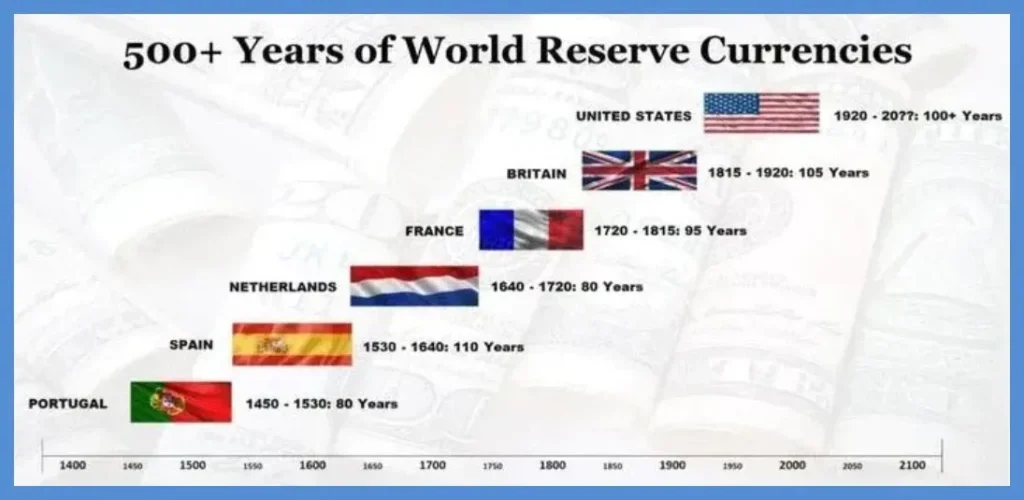

Ritesh calls this a “Brave New World” and believes that we are in a Kondratiev winter phase for the greenback (reserve currency).

According to Ritesh, as we progress towards de-dollarization, commodity producers and high gold ownership countries will see their currencies strengthen as they have tangible assets to barter against rapidly devaluing fiat currencies.

He believes the trend started to post the sanction of Russian FX Reserves last year during the war.

The dollar’s hegemony is unparalleled as the global reserve currency, accounting for 90% of the total trade settlements.

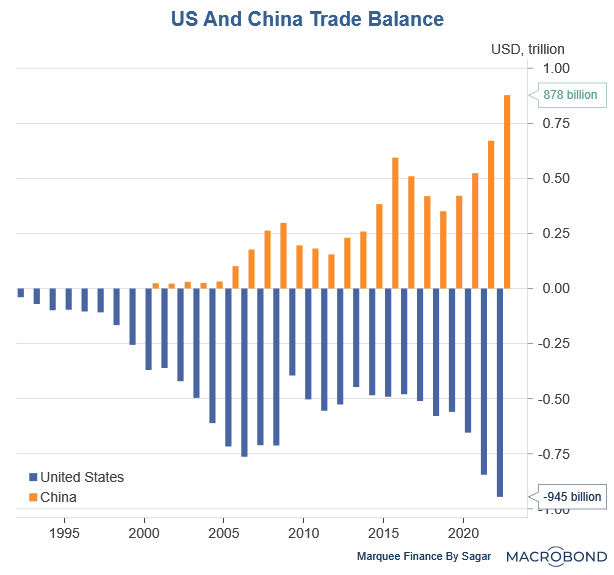

Nevertheless, lately, the US has been running massive trade deficits as China has become the world’s factory (post its entry into WTO in 2001).

De-Dollarization Challenge 1: Timestamp: 5.30

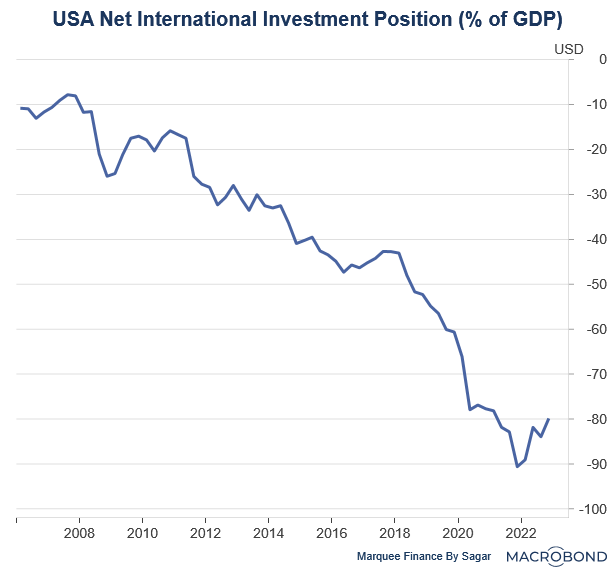

The US runs persistent trade deficits, and the resulting massive CAD (Current Account Deficit) is financed by the recycling of surplus dollars by the current account surplus countries like (Japan, China and Saudi Arabia) into the US assets like the Treasuries. As a result:

USA’s net investment position has been falling drastically.

Ritesh says that Petroyuan is not the future because China has a closed capital account and China does not run CAD. He shared data which shows that China’s FX reserves were 46% of GDP in 2013, which plunged to 26% by 2018 and now has drastically reduced to 18%.

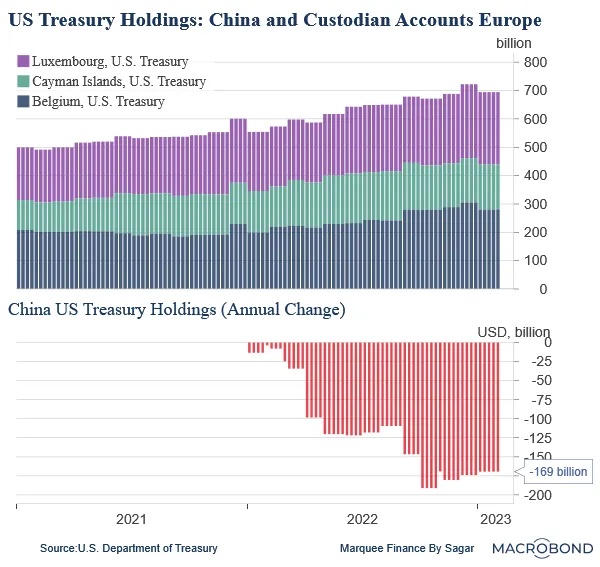

PS: Markets speculate that China has been “mysteriously” buying USTs through various custodian accounts in Europe to protect itself from likely future sanctions.

He says that the incremental dollar has been buying assets worldwide (and not the US) since Xi took power in 2014.

He also believes that Gold Standard is not the way forward in a fractional reserve banking system.

De-Dollarization Challenge 2: Timestamp: 10:45 (Global Dollar Liabilities)

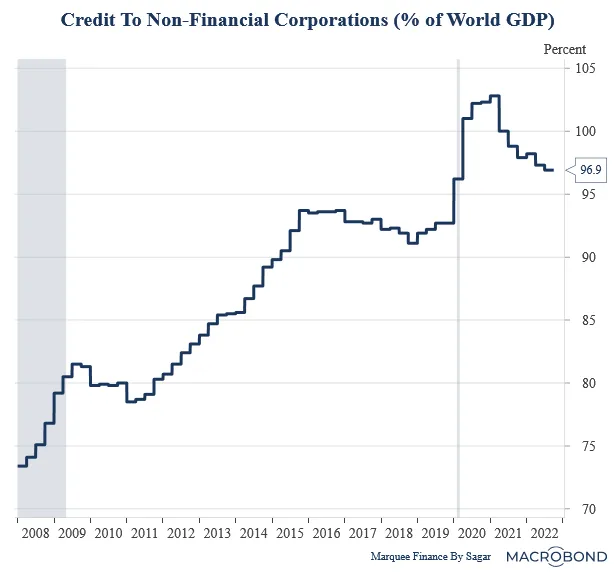

Since the GFC, the private sector has accumulated a lot of leverage (96% of the world GDP), and unsurprisingly, more than half of this debt is dollar-denominated (around $12 trillion).

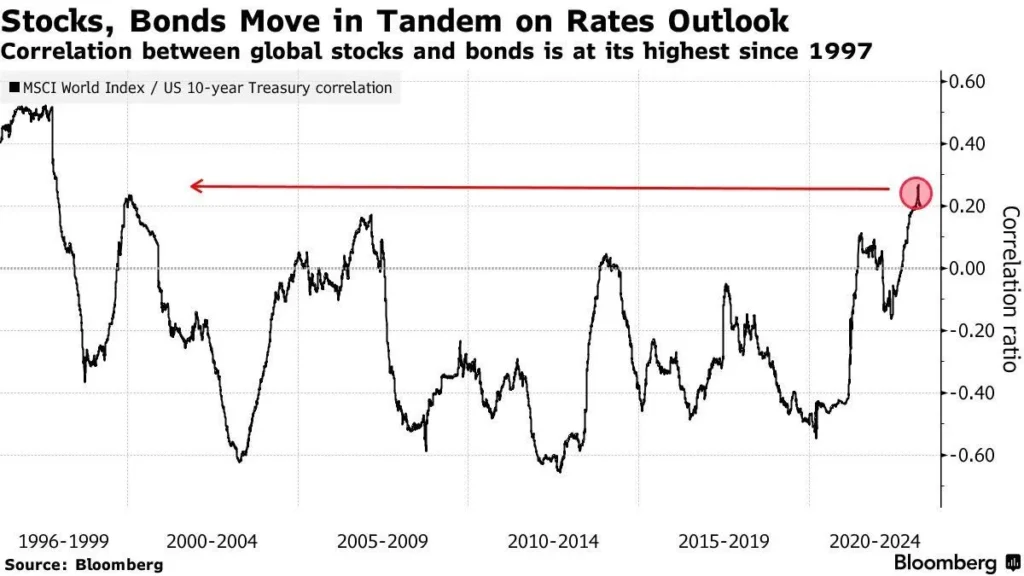

So when I asked Ritesh about how will the private sector and even the sovereigns cope with a dollar shortage in the initial phase of the “supposed” De-Dollarization, he said that there would be enormous selling of the US-denominated assets, a playbook similar to the covid crash when US bonds and equities fell simultaneously.

Timestamp: 13.30 (Stagflation)

Next, we discussed the likely stagflationary scenario in the next decade due to the likely buoyant commodity prices resulting from the multi-polar world.

According to Ritesh, stagflation is the most likely outcome for countries with higher debt, low GDP growth and huge underfunded liabilities (most of G-7, ex-Japan). On the other hand, he believes EMs with lower government and HH debt and young demographics will be able to absorb the associated cost of deglobalization.

He believes that local consumption will drive growth in EMs in the new multipolar world.

Timestamp: 18:00 (Liquidity Framework)

At Pinetree Macro, Ritesh focuses on the liquidity framework of investing while investing across global assets.

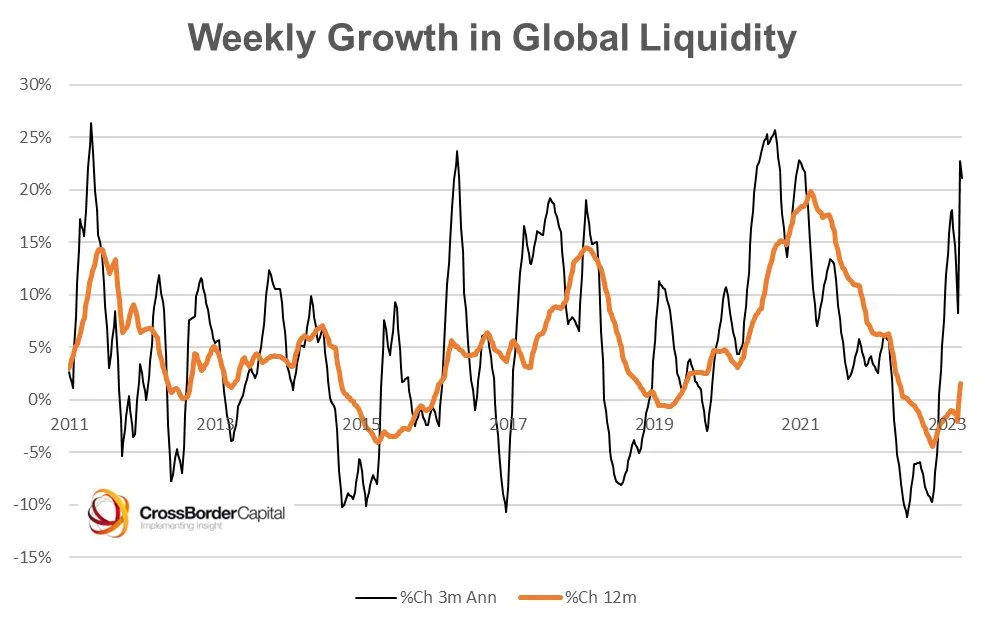

He informed me that according to the research done by Cross-Border Capital, there is a highly tight correlation (0.8) between global liquidity and all the global wealth spread across equities, real estate, gold and fixed income. At PineTree, Ritesh follows the liquidity trail and invests accordingly in the underlying ETFs.

Timestamp: 20:10 (Global Liquidity and Its Outlook)

As per Cross Border Capital, global liquidity bottomed out in October last year.

Ritesh told me that CB liquidity is up by a whopping $1 Trillion in the last three months due to PBoC, BoJ and the debt ceiling (which is adding liquidity via TGA: Treasury General Account).

He believes that post-June (H2), we will be in a risk-off environment as liquidity wanes.

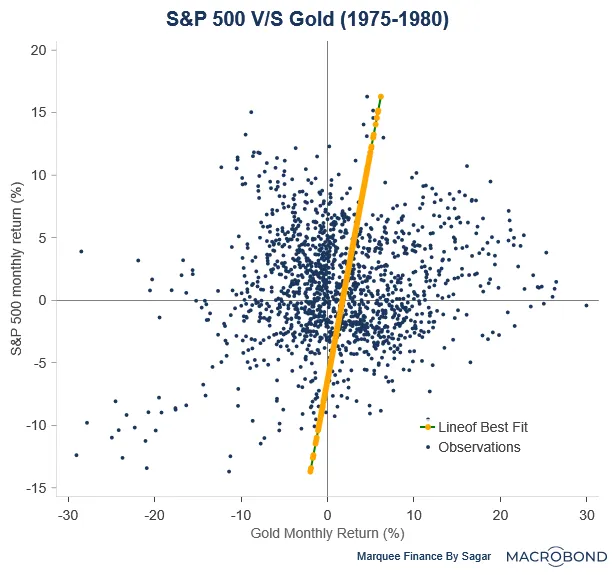

When we talk about asset class performance, the 70s experience shows that equities and bonds don’t perform well in the stagflationary scenario.

Furthermore, a positive correlation between the two means that the 60:40 portfolio doesn’t provide the necessary cushion to investors.

Timestamp: 26:40 (Gold)

Ritesh has a very bold bet for the stagflationary era.

I am text block. Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

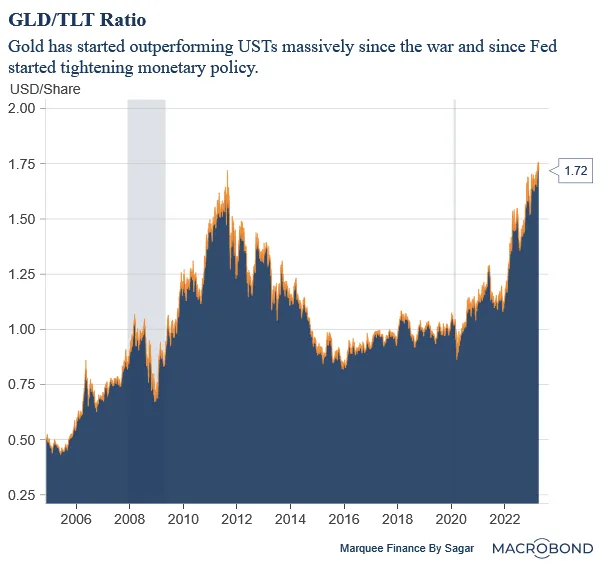

He thinks one should replace 40% of their bond portfolio with Gold until the US Debt/GDP ratio comes down to 70-80% from 130% today (happened last time in 1944 post-WW2)!!

According to him, the signs are emerging that bonds will massively underperform Gold due to financial repression.

And for a fact, he is not wrong (at least until now).

In the equity part, he likes the green energy transition companies, commodity producers and companies aligned with government policies.

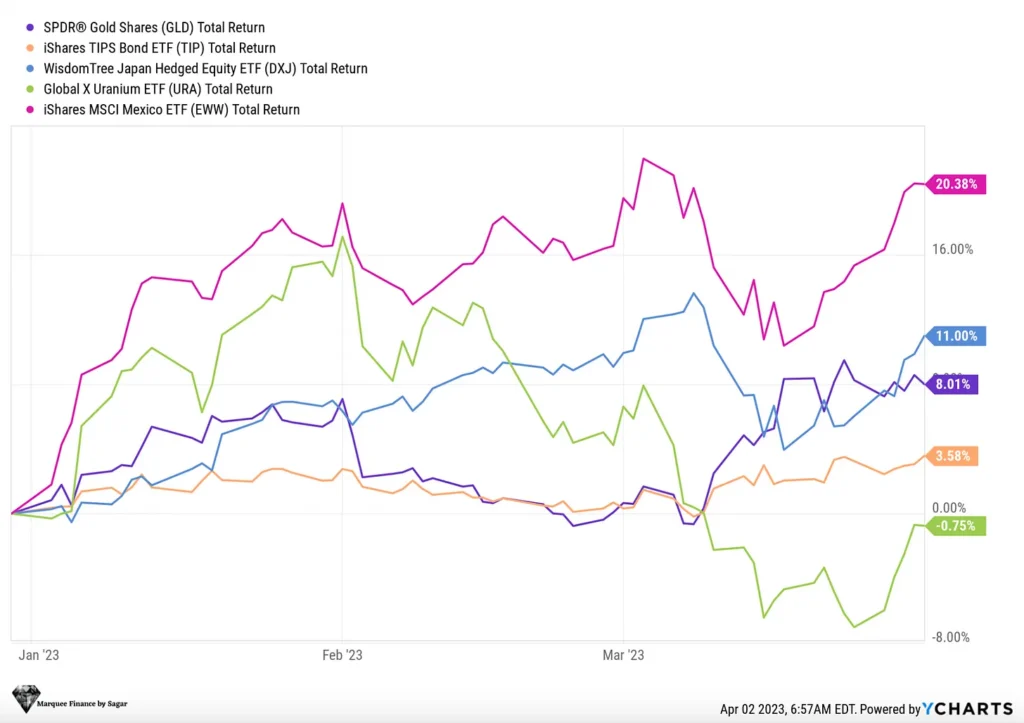

Ritesh currently has an exposure of 8.36% to GLD 0.40%↑ , which is the highest allocation.

He believes that the post-WW2 era and the 70s experience show that Gold can’t be neglected.

PineTree Macro’s top 5 holdings are Gold, TIPS Bond ETF, DXJ, Uranium ETF and EWW.

Timestamp: 32.55 (Uranium)

The rationale behind holding the URA/URNM is that Ritesh believes that Uranium miners will immensely benefit from the green transition.

Timestamp: 34.28 (Japan)

DXJ is the only currency-hedged ETF in the world, and he thinks inflation will be a tailwind for Japanese banks (rising rates leading to steepening of the yield curve).

Guess What: Warren Buffett is also buying Japanese stocks! (Recently filed for raising Yen Denominated Notes as well and visited Japan as well)

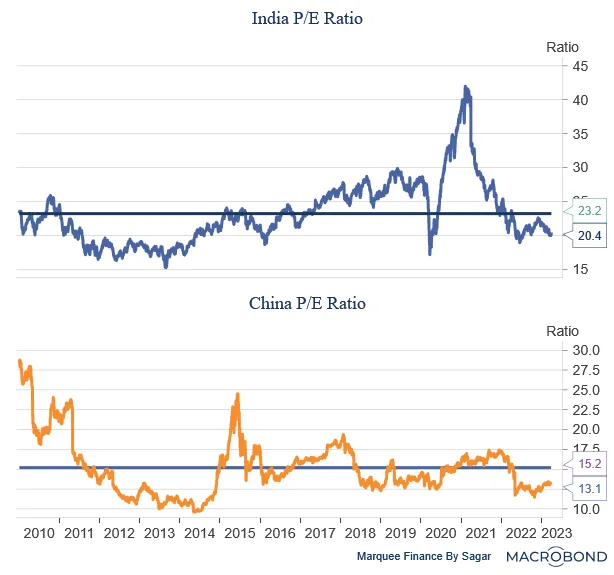

Timestamp: 39.05 (India and China)

Indian equities have always been expensive compared to EM peers due to its growth potential and demographics.

Nevertheless, the cheap Chinese equities mean investors have been rotating from Indian to Chinese equities since October.

Ritesh is very bullish on India and believes it’s going through a time correction. He lists the limited post covid stimulus as a catalyst for stable inflation in India; and thinks PLI Scheme can be a game-changer in the medium to long term.

He also remains bullish on medium-tenor bonds in India.

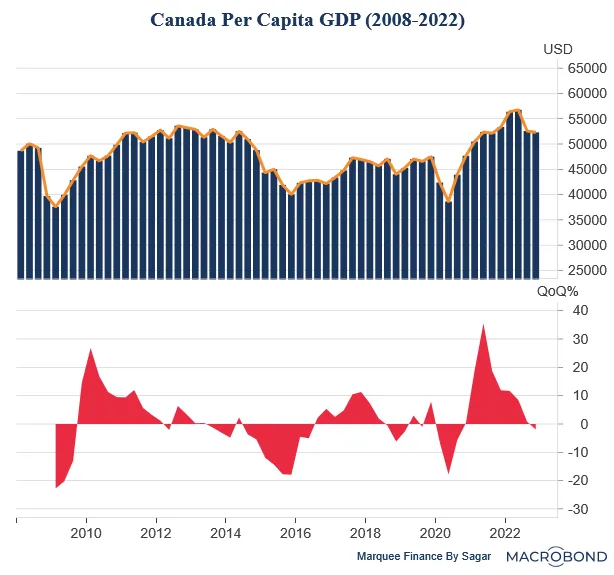

Timestamp: 42.45 (Canada)

Canada has been facing a lot of headwinds with stagnant per capita income, a languishing private sector and an overleveraged housing market.

Ritesh told me that people depend upon asset inflation and household debt for consumption in Canada; thus, as a result, Canada will be growing at less than 1 % for a long period, as per OECD.

Nevertheless, Ritesh highlighted that he would be highly bullish on CAD and Canadian equities if favourable policies were drafted to reform the natural resources sector and increase exports.

I really enjoyed the insightful conversation with Ritesh, and I hope you will also enjoy the same!