Anantam International SPC Fund - 6 SP

Investment Objective

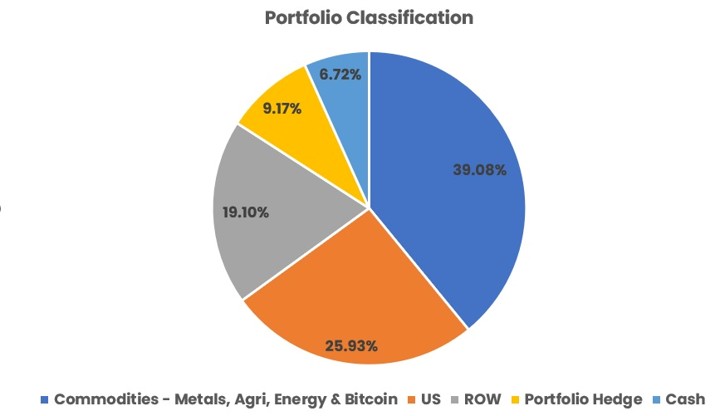

To provide with income generation and capital appreciation through investments in equities, bonds and other related securities of emerging and developed markets. This objective is to be achieved by investing in debt, quasi equity (including convertible bonds, warrants, etc.) and equity shares, both listed and unlisted in, developed, emerging and frontier markets.

| Particulars | Remarks |

|---|---|

| Currency | USD |

| Type | Open ended |

| Minimum Investment | $100,000 |

| Minimum top up post 1st investment | $1000 and multiples thereof |

| Subscription | Weekly, NAV is declared on every Friday and on the last working day of every month |

| Redemption | Anytime, subject to at least 15 calendar days of notice |

| Partial Redemptions | Permitted, subject to post redemption minimum investment at $100,000 |

| Redemption Free/ Exit Load | 1% for exit within 12 months from investing |

| Management Fee | 1% per annum; charged monthly on average AUM |

| Performance Fee | 15% performance fee over hurdle of 7% (subject to high watermark) |

| Operating Fee | On Actuals, capped at 0.5%p.a. on AUM |

| Hurdle Rate | 7% |

| Fund Name | Anantam International SPC Fund – 6 SP (Cayman Island) |

| Investment Manager | Dovetail Investment Management Limited |

| Fund's Bank Account | SBM Bank (Mauritius) Limited |

| Auditor | Forvis Mazars |

| Administrator | Ohm Dovetail Global Admin (IFSC) Private Limited |

Benchmarks

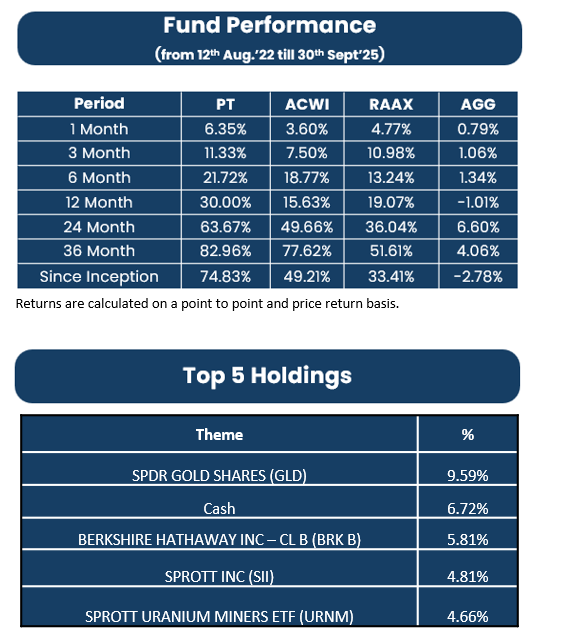

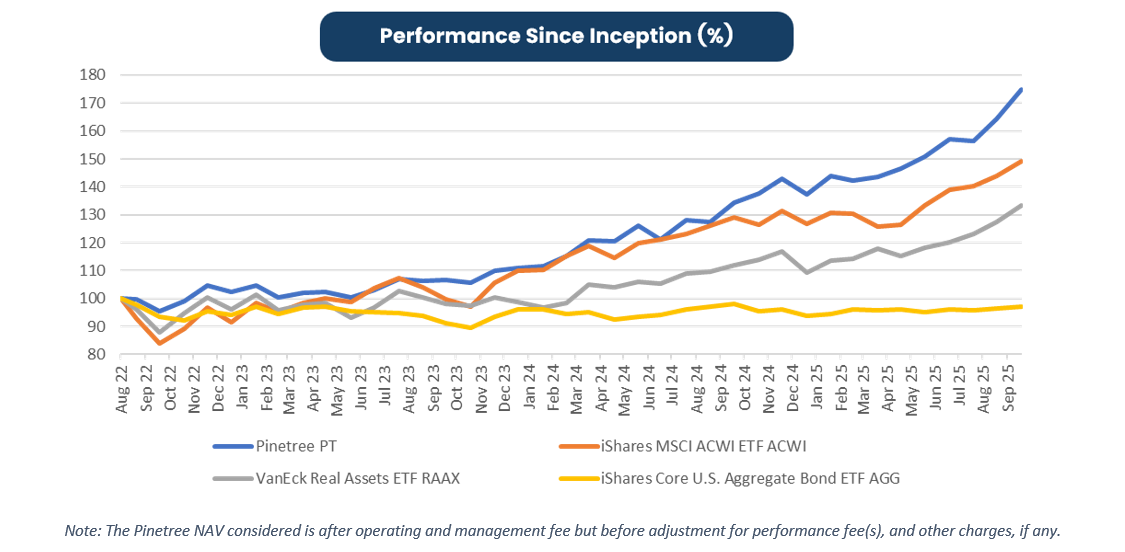

Equity Benchmark – iShares MSCI ACWI ETF (ACWI): Tracks the MSCI All Country World Index, covering large and mid-cap stocks across 23 developed and 24 emerging markets, representing approximately 85% of global equity market capitalization with U.S. exposure of 64.28%. Serves as a comprehensive reference for global equity performance.

Bond Benchmark – iShares Core U.S. Aggregate Bond ETF (AGG): Tracks the Bloomberg U.S. Aggregate Bond Index, representing the U.S. investment-grade bond market including Treasuries, mortgage-backed securities, and corporate bonds. Serves as the standard reference for U.S. fixed income performance.

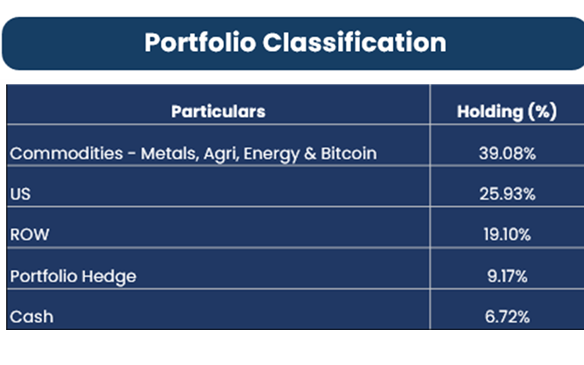

Real Assets Benchmark – VanEck Real Assets ETF (RAAX): Provides diversified exposure to commodities, natural resource equities, REITs, infrastructure, and gold. Selected to capture the role of real assets as an inflation hedge and as a diversifier against equity and bond risks.

Peers in the space typically use a 60:40 blend of the MSCI World Stock Index and Bloomberg Global Bond Index as a benchmark. However, we have chosen to present three distinct benchmarks, each at 100% weight, to more clearly reflect PineTree’s investment style and asset allocation.

The inclusion of a real assets benchmark reflects our macro view: as early signs of a multipolar currency world emerge, global supply chain efficiency will be tested, driving procurement costs higher. At the same time, developed economies face mounting debt. In this environment, real asset owners such as commodity producers and efficient commodity procurers are well positioned to benefit. Incorporating real assets into the benchmark increases the challenge for our fund, as hard commodities also serve as an important hedge against inflation.

Together, ACWI, AGG, and RAAX provide a transparent framework to evaluate PineTree’s performance across global equities, U.S. fixed income, and real assets. Each benchmark was selected for its accuracy in representing the targeted asset class and relevance to the current macroeconomic environment.